Chief Exec’s report Q2 2021

Welcome all to this quarterly review of our sector’s outlook, one that brings some welcome and justifiable optimism for the first time in 12 months, albeit with some notes of caution too. It would have been naïve to think that we could enjoy a straightforward across the board upturn, and we should take a minute to note the relative speed at which an upbeat outlook has arrived, as this timeline looks distinctly different from the recessionary impacts of recent years. That difference is a key driver of caution, as we all will want to see this trajectory sustained and extended to all before we start any celebrations.

Let’s start with areas where further improvement is needed, and our first thoughts stay with precision machining companies where the continued lack of activity in civil aerospace and oil and gas explain their low order response whilst others have moved to positive. A forward view shows a forecast improvement in domestic and export orders, reflected in a mild pick up in optimism, but these remain tough times for those companies, and the return to aviation traffic approaching pre pandemic levels remains some time away. For companies in this predicament, their skills and capability are highly transferable, and if Covid has underlined one truth, it has been the value of shorter supply chains – a value to both supplier and customer equally. The team at Scottish Engineering welcome the opportunity to connect companies with capacity to those who wish to explore those benefits, please contact us if you can help yourself and fellow members in this way.

Another tricky topic that has impacted almost everyone is increasing pricing – and availability – of raw materials. Everything from metals to plastics, cardboard to hydraulic oils seem to have been on an upward spiral and short supply. In some cases, it’s been difficult to separate the Covid and Brexit impacts affecting these goods, but there is no lack of clarity on the concern it brings and the subsequent movement on pricing which has had to be passed along. Short supply places additional pressure on meeting promised delivery timing for customers who need to be retained, and so this is an area we will all be watching carefully for improvement.

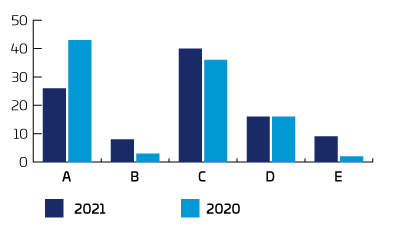

Sector Change in Net Zero Opportunity vs Concern

A – Concerned

B – Deeply Concerned

C – Neutral

D – Opportunity

E – Strong Opportunity

What about the good news then? Well, there are quite a few significant highlights to mention, but my starting pick is exports, with the most strongly positive response since June 2018, and I say that while acknowledging that everything is relevant, but also countering that exports are essential to a strong Scottish engineering sector, and hence this is especially welcome. It’s good to see our fabrication companies’ substantial increases in forecast orders mirroring the overall increase across construction, and staffing numbers are forecasted to rise between thirteen and fifty percent for all. Thankfully, the outlook for additional staff is reflected in a strong training investment intention, essential to hold up our fragile skills supply. We know that a significant proportion of the redundancies of the last year were retirements and therefore likely permanent loss of skills, and these are combined with a fifty percent drop in new apprentice starts in the same period, so picking up the pace on training is both welcome and essential.

Recovery in economic terms from the pandemic is of course not only different from other recoveries by its timeline, but also the intent on how we should recover, with the path to net zero emissions front and centre and woven in to almost every supporting policy by both UK and Scottish governments. In this survey we revisited the questions we asked companies one year ago around their climate emergency views and added some new based on a better understanding of the key measures of progress. So, in a year we see a ten percent reduction in companies who are concerned or deeply concerned at the threat that their business faces from the climate emergency, with seven percent moving to see opportunity or strong opportunity instead. One quarter of responding companies now have some level of dedicated resource tasked with driving progress in their net zero actions, and more than half are aware of the detailed scopes outlined in the greenhouse gas protocol. Two key measures which have unfortunately not moved in the last year are the related pursuit of operational and product/service changes to support reduced climate impact. In that respect, our concern is that companies in our sector don’t get left behind by a changing landscape that will not pause, and here we believe we can help. Our net zero skills support programme launched in April is free and open to all and aims to give straightforward practical help to all companies regardless of where their net zero journey is at – please get in touch if we can help.

Scottish Engineering sees that it is our responsibility to link the supply chain opportunities coming from the shift in industrial focus required to meet net zero – in areas such as energy, transport and heating – and this underlines that our industry association intends to fulfil a key role in supporting companies in diversifying and growing in these areas.

Paul Sheerin

Chief Executive

Scottish Engineering