Key attention points from this quarter:

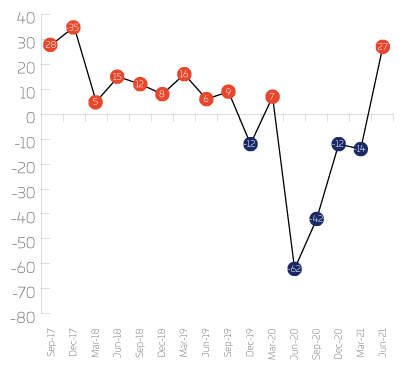

- Order intake, Output Volume, Exports and Staffing are all positive at once for the first time since June 2019

- Order intake for the last 3 months up 27%, forecast further positive 39% for next 3 months

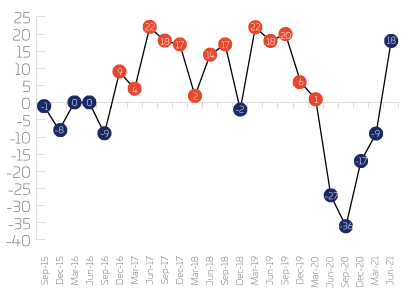

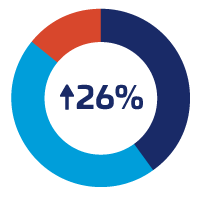

- Optimism moves from negative for the first time in 12 months to net 26% positive

- High value precision machining orders show improvement but stand alone as the only negative order return at -20%

- UK and Export prices reflect raw material price movements at net 44% and 34% increases respectively

The data in this Review were acquired by a survey of Scottish Engineering’s members and certain other manufacturing companies.

35% of members responded

Companies are described as:

Small (<100 employees), Medium (100–500) and Large (>500)

Order intake, output volume, exports and staffing have all improved significantly from negative to positive since last quarter. Order intake is up 36 percentage points, output volume is up 31 percentage points, exports are up 30 percentage points and staffing is up 27 percentage points, with all four measurements last showing concurrently positive in June 2019.

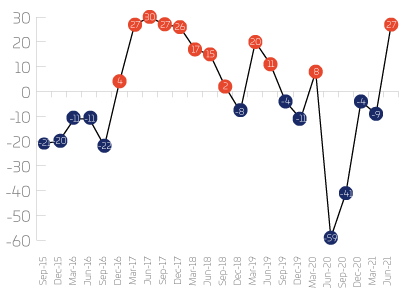

Order intake

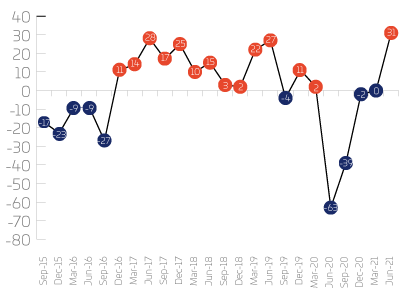

Output volume

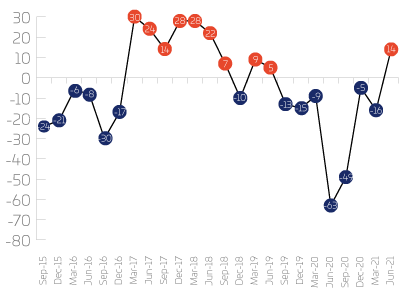

Exports

Staffing

Net | Up | Same | Down | |

UK Orders | 18% | 43% | 33% | 24% |

Small | 12% | 40% | 32% | 28% |

Medium | 32% | 48% | 36% | 16% |

Large | 25% | 50% | 25% | 25% |

Machine | -30% | 20% | 30% | 50% |

Mechanical | 48% | 62% | 24% | 14% |

Metal | 38% | 63% | 13% | 25% |

Non-metal | 20% | 40% | 40% | 20% |

Fabricators | 36% | 55% | 27% | 18% |

Electronics | 0% | 33% | 34% | 33% |

UK orders have swung into the positive, with the balance of change at 18% (33 percentage points more than last quarter). All sizes of company are reporting increases, with almost all sectors positive, and only machine shops reporting a negative return.

Net | Up | Same | Down | |

Export | 14% | 42% | 29% | 29% |

Small | 2% | 34% | 34% | 32% |

Medium | 23% | 50% | 23% | 27% |

Large | 100% | 100% | 0% | 0% |

Machine | -50% | 17% | 16% | 67% |

Mechanical | 42% | 58% | 27% | 15% |

Metal | -43% | 14% | 29% | 57% |

Non-metal | 20% | 60% | 0% | 40% |

Fabricators | -20% | 20% | 40% | 40% |

Electronics | 50% | 63% | 24% | 13% |

Export orders are positive this quarter, with the balance of change at 14%. All sizes of company are reporting increases, the balance of change is 2% for small companies, 23% for medium companies, and 100% for large companies. In the sectors there is a mix; the balance of change is 50% for electronics, 42% for mechanical equipment, 20% for non-metal products, -20% for fabricators, -43% for metal manufacturing and -50% for machine shops.

Net | Up | Same | Down | |

Optimism | 26% | 40% | 46% | 14% |

Small | 22% | 39% | 45% | 16% |

Medium | 31% | 42% | 46% | 12% |

Large | 50% | 50% | 50% | 0% |

Machine | 20% | 40% | 40% | 20% |

Mechanical | 43% | 43% | 57% | 0% |

Metal | 13% | 25% | 62% | 13% |

Non-metal | 40% | 40% | 60% | 0% |

Fabricators | -9% | 36% | 19% | 45% |

Electronics | 20% | 40% | 40% | 20% |

Optimism has moved to positive, with the balance of change at 26% (35 percentage points higher than last quarter). All sizes of company are reporting positive returns: small companies 22%, medium companies 31% and large companies 50%. Across the sectors it’s a similar scene, with only fabricators reporting a negative return.

Net | Up | Same | Down | |

Output | 31% | 51% | 29% | 20% |

Small | 24% | 46% | 32% | 22% |

Medium | 44% | 60% | 24% | 16% |

Large | 75% | 75% | 25% | 0% |

Machine | -10% | 30% | 30% | 40% |

Mechanical | 50% | 60% | 30% | 10% |

Metal | 0% | 50% | 0% | 50% |

Non-metal | 20% | 20% | 80% | 0% |

Fabricators | 45% | 64% | 18% | 18% |

Electronics | 60% | 70% | 20% | 10% |

Output volume has improved 31 percentage points since last quarter and the balance of change is now 31. All sizes of company are positive and the majority of sectors are reporting positive returns. Machine shops are reporting decreases and metal manufacturing are reporting equal numbers of increases and decreases.

Net | Up | Same | Down | |

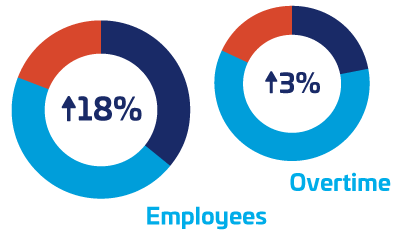

Staffing | 18% | 36% | 45% | 19% |

Small | 0% | 24% | 52% | 24% |

Medium | 50% | 58% | 34% | 8% |

Large | 100% | 100% | 0% | 0% |

Machine | 0% | 10% | 80% | 10% |

Mechanical | 20% | 40% | 40% | 20% |

Metal | 0% | 38% | 24% | 38% |

Non-metal | -20% | 0% | 80% | 20% |

Fabricators | 9% | 36% | 37% | 27% |

Electronics | 10% | 30% | 50% | 20% |

Employees

Employee numbers are positive for medium and large companies, and small companies are reporting equal numbers of increases and decreases. Mechanical equipment, fabricators and electronics are reporting increases, non-metal products are reporting reductions in employee numbers and machine shops and metal manufacturing are reporting equal numbers of increases and decreases.

Net | Up | Same | Down | |

Overtime | 3% | 22% | 60% | 18% |

Small | -2% | 19% | 60% | 21% |

Medium | 16% | 32% | 52% | 16% |

Large | 0% | 0% | 100% | 0% |

Overtime working has picked up, medium companies are reporting increases, large companies have remained the same as last quarter and it is still reduced for small companies.

Net | Up | Same | Down | |

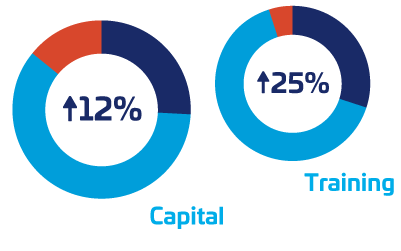

Investment | 12% | 26% | 60% | 14% |

Small | 6% | 22% | 62% | 16% |

Medium | 23% | 35% | 53% | 12% |

Large | 25% | 25% | 75% | 0% |

Machine | -20% | 10% | 60% | 30% |

Mechanical | 17% | 24% | 69% | 7% |

Metal | -13% | 13% | 62% | 25% |

Non-metal | 60% | 60% | 40% | 0% |

Fabricators | -10% | 20% | 50% | 30% |

Electronics | 44% | 44% | 56% | 0% |

Investment

Capital investment plans have improved since last quarter, with all sizes of company reporting positive net returns. Within the sectors mechanical equipment, non-metal products, and electronics are reporting positive net returns, and machine shops, metal manufacturing and fabricators are reporting negative net returns.

Net | Up | Same | Down | |

Training | 25% | 30% | 65% | 5% |

Small | 19% | 24% | 72% | 4% |

Medium | 42% | 50% | 42% | 8% |

Large | 0% | 0% | 100% | 0% |

Small and medium companies are reporting positive figures for training investment and large companies have remained the same as last quarter.

Capacity Utilisation

Capacity utilisation has risen 41 percentage points since last quarter and is positive for the first time since Q1 2020. The increase reflects the movement in order intake and output volume.

Electronics

Order Intake Total Electronics order intake is positive (increased 54 percentage points) after two negative quarters.

Forecast

Looking to the next 3 months, forecasts are good, with all measures positive. The net balance of change for overall orders is 39%, UK orders 34%, export orders 32% and output volume 36%. All sizes of company are forecasting positive figures for UK order intake, orders export, UK prices, export prices, output volume and employee numbers. Across the sectors all measurements are positive except for metal manufacturing who are forecasting a dip in export orders.

| Net | Up | Same | Down | |

Orders | 39% | 49% | 41% | 10% |

UK Orders | 34% | 46% | 42% | 12% |

Export Orders | 32% | 38% | 57% | 5% |

Output Volume | 36% | 46% | 43% | 11% |

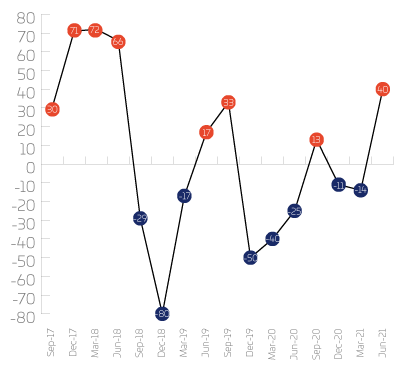

Balance of change %

| Order Intake UK | Orders Export | Prices UK | Prices Export | Output Volume | Employees | |

|---|---|---|---|---|---|---|

| Small | 28 | 27 | 41 | 40 | 30 | 25 |

| Medium | 52 | 36 | 32 | 23 | 48 | 46 |

| Large | 25 | 75 | 25 | 25 | 50 | 25 |

| Metal Manufacturing | 25 | -14 | 25 | 14 | 25 | 13 |

| Non-Metal Products | 40 | 40 | 60 | 40 | 40 | 40 |

| Electronics | 11 | 38 | 56 | 50 | 56 | 50 |

| Fabricators | 36 | 0 | 36 | 20 | 36 | 18 |

| Machine Shops | 10 | 17 | 20 | 17 | 10 | 10 |

| Mechanical Equipment | 57 | 46 | 45 | 42 | 47 | 37 |