Key highlights from this quarter:

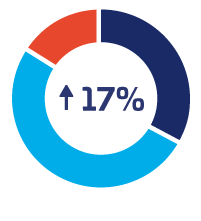

- Confidence shoots up from -5% last quarter to +17% this period

- Forecast orders for the next three months show a net +42%

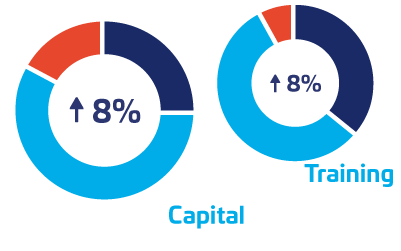

- Training investment remains positive at net +8%

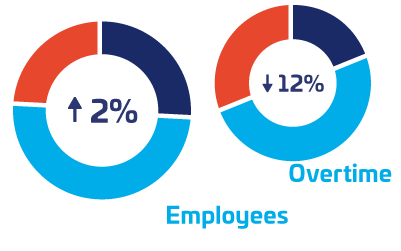

- Staffing remains stable at +2% reflecting available capacity to meet upturn following lower previous quarter output

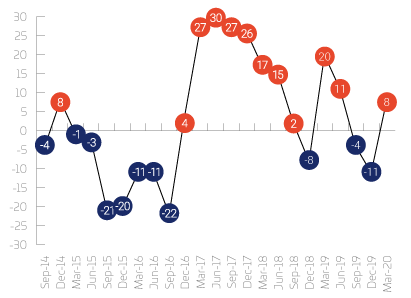

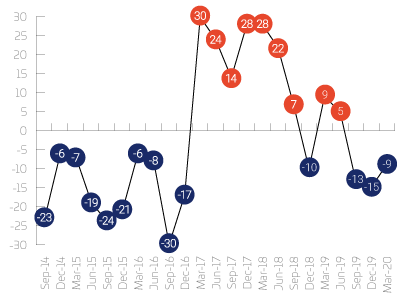

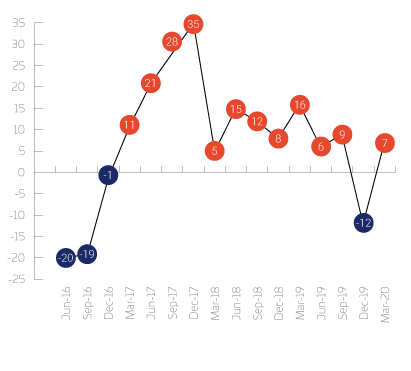

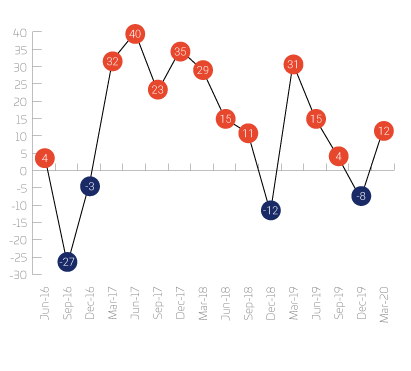

Order intake has swung into positive territory after dipping for two consecutive quarters. Output volume has dipped by nine percentage points, but still remains positive.

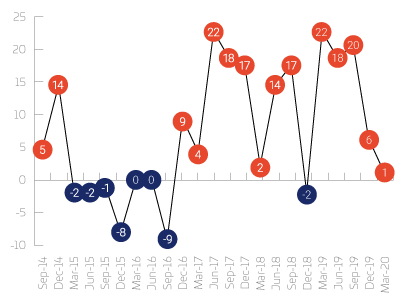

Export levels remain negative but have improved since last quarter and staffing levels have dipped but are still positive

Order intake

Output volume

Exports

Staffing

Net | Up | Same | Down | |

UK Orders | -3% | 29% | 39% | 32% |

Small companies | 0% | 29% | 42% | 29% |

Medium companies | 0% | 33% | 34% | 33% |

Large companies | -60% | 0% | 40% | 60% |

Machine shops | -22% | 22% | 34% | 44% |

Mechanical equipment | -8% | 21% | 50% | 29% |

Metal manufacturing | -12% | 38% | 12% | 50% |

Non-metal products | -16% | 17% | 50% | 33% |

Fabricators | 42% | 58% | 25% | 17% |

Electronics | -40% | 20% | 20% | 60% |

UK orders are negative, with the balance of change at -3% (13% higher than last quarter). Small and medium sized companies are reporting equal numbers of increases and decreases, whilst large companies have moved from a positive to negative position. Within the sectors fabricators are reporting positive returns. Machine shops, mechanical equipment, metal manufacturing, non-metal products and electronics are all reporting negative returns.

Net | Up | Same | Down | |

Export Orders | -9% | 26% | 39% | 35% |

Small companies | -10% | 23% | 44% | 33% |

Medium companies | -9% | 29% | 33% | 38% |

Large companies | 0% | 40% | 20% | 40% |

Machine shops | -60% | 0% | 40% | 60% |

Mechanical equipment | 12% | 36% | 40% | 24% |

Metal manufacturing | -29% | 14% | 43% | 43% |

Non-metal products | -40% | 20% | 20% | 60% |

Fabricators | -50% | 0% | 50% | 50% |

Electronics | -60% | 0% | 40% | 60% |

Export orders are negative for small and medium companies, and there are equal numbers of increases and decreases for large companies. The balance of change is -10% for small companies, -9% for medium companies, and 0% for large companies. In the sectors mechanical equipment are positive and machine shops, metal manufacturing, non-metal products, fabricators and electronics are reporting negative returns.

Net | Up | Same | Down | |

Optimism | 17% | 33% | 51% | 16% |

Small companies | 20% | 37% | 46% | 17% |

Medium companies | 7% | 21% | 65% | 14% |

Large companies | 40% | 60% | 20% | 20% |

Machine shops | 11% | 22% | 67% | 11% |

Mechanical equipment | 12% | 27% | 58% | 15% |

Metal manufacturing | 13% | 38% | 37% | 25% |

Non-metal products | -50% | 0% | 50% | 50% |

Fabricators | 50% | 50% | 50% | 0% |

Electronics | -60% | 0% | 40% | 60% |

Optimism has swung into positive territory and is 22% points higher than last quarter. All sizes of company are reporting increases. In the various sectors machine shops, mechanical equipment, metal manufacturing and fabricators are positive; machine shops and fabricators are reporting equal numbers of increases and decreases; and non-metal products and electronics are negative.

Net | Up | Same | Down | |

Output volume | 2% | 35% | 33% | 33% |

Small companies | 2% | 30% | 42% | 28% |

Medium companies | 4% | 43% | 18% | 39% |

Large companies | 0% | 40% | 20% | 40% |

Machine shops | -22% | 22% | 34% | 44% |

Mechanical equipment | 23% | 42% | 39% | 19% |

Metal manufacturing | -12% | 38% | 14% | 50% |

Non-metal products | -33% | 17% | 33% | 50% |

Fabricators | 16% | 33% | 50% | 17% |

Electronics | -80% | 0% | 20% | 80% |

Output volume is positive for small and medium companies and large companies are reporting equal numbers of increases and decreases. Across the sectors mechanical equipment and fabricators are positive; machine shops, metal manufacturing, non-metal products and electronics are negative.

Net | Up | Same | Down | |

Staffing | 2% | 26% | 50% | 24% |

Small companies | 2% | 28% | 46% | 26% |

Medium companies | 0% | 31% | 58% | 21% |

Large companies | 0% | 20% | 60% | 20% |

Machine shops | 0% | 22% | 56% | 22% |

Mechanical equipment | 8% | 27% | 54% | 19% |

Metal manufacturing | 0% | 38% | 24% | 38% |

Non-metal products | -17% | 0% | 83% | 17% |

Fabricators | 9% | 17% | 75% | 8% |

Electronics | -60% | 0% | 40% | 60% |

Employees

Employee numbers are positive for small and medium companies, and negative for large companies. Machine shops and metal manufacturing have increased; mechanical equipment, non-metal products and fabricators have reported decreases, and electronic companies have reported equal numbers of increases and decreases.

Net | Up | Same | Down | |

Overtime | -12% | 19% | 50% | 31% |

Overtime working has decreased for all sizes of companies.

Net | Up | Same | Down | |

Investment | 8% | 25% | 58% | 17% |

Small companies | 8% | 21% | 66% | 13% |

Medium companies | 7% | 30% | 48% | 22% |

Large companies | 20% | 40% | 40% | 20% |

Machine shops | 44% | 56% | 33% | 11% |

Mechanical equipment | 4% | 19% | 66% | 15% |

Metal manufacturing | 0% | 43% | 14% | 43% |

Non-metal products | -16% | 17% | 50% | 33% |

Fabricators | 17% | 17% | 83% | 0% |

Electronics | -20% | 0% | 80% | 20% |

Investment

Capital investment plans remain positive, although they have fallen slightly since last quarter. Within the sectors machine shops, mechanical equipment, and fabricators are positive; non-metal products and electronics are negative; and metal manufacturing are reporting equal numbers of increases and decreases.

Net | Up | Same | Down | |

Training investment | 8% | 36% | 56% | 8% |

Training investment plans have improved slightly since last quarter, and all sizes of company are continuing to report positive figures.

Capacity Utilisation

Capacity utilisation has returned to positive after dipping into negative territory last quarter.

Mechanical equipment

Order intake total Mechanical equipment order intake has returned to positive levels after a dip last quarter.

Forecast

Forecasts for the next three months are more positive than previous quarters. In general, UK orders, export orders and output volume are forecast to pick up. Small and medium companies are forecasting positive figures for all measurements. Large companies are forecasting decreases in output volume and employee numbers.

Electronics, fabricators, machine shops and mechanical equipment are forecasting that the next quarter will be the same as or better than last quarter for all measurements. Metal manufacturing are forecasting a decrease in export orders and non-metal products are forecasting a decrease in employee numbers.

| Net | Up | Same | Down | |

Orders | 42% | 51% | 40% | 9% |

UK Orders | 35% | 45% | 45% | 10% |

Export Orders | 27% | 36% | 55% | 9% |

Output Volume | 30% | 40% | 50% | 10% |

Balance of change %

| Order Intake UK | Orders Export | Prices UK | Prices Export | Output Volume | Employees | |

|---|---|---|---|---|---|---|

| Small | 27 | 22 | 20 | 10 | 28 | 9 |

| Medium | 52 | 38 | 15 | 24 | 39 | 18 |

| Large | 40 | 20 | 60 | 20 | -20 | -40 |

| Metal Manufacturing | 25 | -15 | 25 | 14 | 38 | 0 |

| Non-Metal Products | 50 | 0 | 50 | 40 | 33 | -17 |

| Electronics | 20 | 20 | 0 | 0 | 20 | 0 |

| Fabricators | 16 | 0 | 36 | 50 | 25 | 17 |

| Machine Shops | 56 | 20 | 11 | 20 | 44 | 22 |

| Mechanical Equipment | 45 | 54 | 25 | 4 | 23 | 12 |