Late payers & reducing the risk of non-payment business debts

Author

Byron Crellin

UK Group Business Development Director, The Clearway Group

13 minute read

It is a harsh reality for all businesses that effective management of debt is critical to financial performance and stability. In this paper I will explore the current context and drivers of business debt, specifically economic conditions and rates of insolvency and financial distress, and I will examine best practice for managing debt in terms of data based company profiling and debt recovery procedures.

The Economic Overview

The economic outlook continues to improve, with the Scottish economy set to return to growth in 2024 after remaining largely flat in 2023, although growth is expected to be modest. The UK outlook is similar, with the Bank of England’s latest forecast showing growth of 0.4% in 2024.

Scottish GDP grew 0.4% in the three months to February 2024, and although it fell in March, it is now very likely that the economy will show growth in first quarter of 2024, confirming that we have avoided a recession. The growth in services (0.7% over the three months to February) is encouraging, particularly consumer facing services growth which remains high at 1.3% over the three months. The stabilisation of our manufacturing sector is also welcome, although the further fall in construction shows that growth is far from being widespread.

The Scottish Economic Bulletin – May 2024 reports business activity has strengthened at the start of the year and business optimism is at its highest for 13 months. At the same time, the Purchasing Managers Index (PMI) business survey indicates that business activity in Scotland’s private sector has strengthened at the start of the year and increased for the third consecutive month in March. This was, however, driven by growth in the services sector. Manufacturing activity continued to weaken, though to a lesser extent than in recent months.

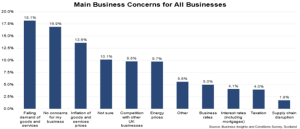

Inflationary pressures have eased but inflation still remains a key business concern in Scotland according to the Business Insights and Conditions Survey.

Looking at a broad range of input costs across the manufacturing and services sectors, PMI business survey data indicates that input prices continued to rise in March, however this indicator is at its lowest level since around the start of 2021.

At the beginning of April, around 8.4% of businesses reported that transportation or haulage costs are causing business to consider raising prices. This potentially reflects the increase in shipping and supply chain costs and delivery times that businesses are facing due to the rerouting of shipping from Asia to Europe round the Cape of Good Hope rather than through the Suez Canal.

Supply-chain disruptions in the Manufacturing sector have also sharply declined from the 11.1% of business reporting concerns in February to 3.7% reporting similar concerns in March.

The Scottish Chambers of Commerce Quarterly Economic Indicator for the first quarter of 2024 highlights a level of caution, reporting that business investment trends remain largely frozen. Over half of businesses (53%) reported no change to total investment and 52% no change to training investment.

To sum up – looking across a range of measures and indicators, the economic picture including that for manufacturing, appears to be modestly encouraging, albeit with a strong degree of caution given some of the volatility and tensions in the global economy.

This analysis in itself would suggest that late or non-payment issues may become less significant, however when we consider the latest information on insolvency and financial distress, there are some more serious concerns for businesses.

Insolvency and financial distress

The Insolvency Service publish monthly statistics on the number of registered company insolvencies in the United Kingdom, presenting the latest data on the numbers of companies that have entered a formal insolvency procedure after being unable to pay their debts.

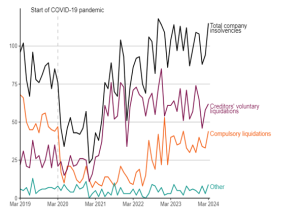

A total of 115 company insolvencies were registered in Scotland in March 2024, 11% higher than the number in March 2023. This was comprised of 44 compulsory liquidations, 62 CVLs (Creditors’ Voluntary Liquidatons) and 9 administrations.

Historically, compulsory liquidations were the most common type of company insolvency in Scotland. However, since April 2020, numbers of CVLs have been higher than numbers of compulsory liquidations.

As the chart below demonstrates, whilst insolvency numbers for 2024 have been running at similar levels to the previous year, the rate remain stubbornly higher that that seen both during and before the COVID-19 pandemic.

Monthly company insolvencies, Scotland, March 2019 to March 2024

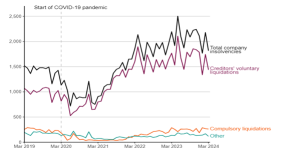

In England & Wales the picture is broadly similar . There were 1,815, company insolvencies in March 2024 consisting of 261 compulsory liquidations, 1,437 creditors’ voluntary liquidations (CVLs), 108 administrations and 9 company voluntary arrangements (CVAs). As can be seen in the chart below, the rates was lower than over the last year, indeed 17 % lower than the March 23, The underlying rate of insolvency, however, remains much higher than that seen during the COVID-19 pandemic and between 2014 and 2019.

Company insolvencies by type, England and Wales, March 2019 to March 2024

Traditionally, construction companies are most at risk of going into liquidation and this has not changed. However, both the retail and the hospitality sectors have nearly caught up with construction in terms of insolvency numbers in 2023.

Financial Distress

The latest Red Flag report from the insolvency practitioner Begbies Traynor states well over half a million companies are suffering significant financial distress – almost 32 per cent higher than in Q1 2023. Also, the much more serious ‘critical’ financial distress category has leapt 20.1 per cent compared to Q1 2023, with 40,174 UK businesses affected.

In conclusion, the evidence is that businesses insolvencies and financial distress are running at historically high levels, as debt servicing at higher interest rates and other business pressures take their toll. THIS IS A RED FLAG FOR ALL BUSINESS SECTORS!

Is your business as risk of not receiving payments that are owed to you?

Recent research shows 44% of UK B2B invoices being overdue in the past 12 months, with a further 8% written off as ‘uncollectable.’

According to the Office for National Statistics, the average profit margin for businesses in the UK stands at 10%. If a business experiences a loss of £10,000, it would necessitate generating an extra £100,000 in turnover to compensate for the shortfall. For the typical SME, achieving this figure is often unrealistic and can ultimately lead to business failure.

How well do you know your customers & suppliers? Do you use Business Credit Scoring techniques ?

Understanding your business exposure to credit risk is critical, and more especially in this current business environment. This takes us to the concept of credit scoring. A business credit score, also called a commercial credit score or rating, is a number that indicates a company’s health. Credit scoring or rating is based on a variety of factors, including credit history, accounts and any outstanding County Court Judgments.

For example, the Clearway business data analytics service clearVIEWbi grades businesses with a score from A – E for their financial situation and can notify when businesses move into a lower rating, prewarning that there may be an issue with their ability to pay their invoices. This allows clients to take a proactive approach in managing their counterparty payment arrangements and ensuring that any monies owed are collected prior to a possible business closure.

clearVIEWbi helps you understand which of your outstanding debtors could pay but refuse to, and which can’t pay.

Clearway, through the clearVIEWbi product, gathers data from various accredited providers and then allows clients to view this data in a clear and concise manner enabling them to make more informed decisions on their trading terms, late payers and business debts. This enables clients to improve cash-flow and reduce business bad debt and potential write-offs.

The profiling software solution categories businesses into three segments:

- Those that are financially stable

- Those that are paying nonpriority debt

- Those that are experiencing financial hardship and possibly vulnerable

clearVIEWbi is a powerful system interface that has delivers a comprehensive suite of commercial data, credit ratings and analytics, generating enhanced visibility into corporate distress and the potential for payment default.

When a payment becomes late

Debt can be a severe issue for businesses, with unpaid invoices, accounts in arrears and the time burden required to repeatedly chase amounts owing causing additional work, stress, and cost – with many companies unable to recoup outstanding payments.

You can, however, claim interest and debt recovery costs if another business is late paying for goods or a service.

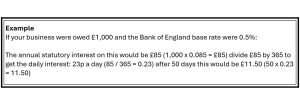

The interest you can charge if another business is late paying for goods or a service is ‘statutory interest’ – this is 8% plus the Bank of England base rate for business to business transactions. You cannot claim statutory interest if there’s a different rate of interest in a contract.

You can also charge a business a fixed sum for the cost of recovering a late commercial payment on top of claiming interest from it.

The Late Payment of Commercial Debts (Interest) Act 1998 gives businesses a statutory right to claim interest and reasonable debt recovery costs from their customers who have failed to pay their debts on time under commercial contracts for the supply of goods or services; and for connected purposes.

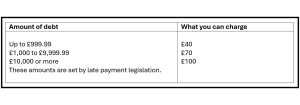

The amount you’re allowed to charge depends on the amount of debt. You can only charge the business once for each payment.

Debt recovery options

To recover money you’re owed by a person or business, you can:

- Use a mediation service

- Make a court claim for your money

- Send a formal request for the debt to be paid (a ‘statutory demand’)

- You can also consider making someone bankrupt if they cannot pay.

- Use a pre-legal debt recovery & business tracing service provider such as Clearway.

Legal proceedings are of course an option but are time and cost-intensive, often a last resort, and only viable when the debt is substantial enough to warrant the expense of a court case or formal litigation.

Pre-legal debt recovery is an escalation to internal credit control taken before the consideration of legal action. It is a letter-telephone recovery cycle that involves a range of debt recovery actions that can avoid the need to pursue a court order to recover debts owing – it is often the fastest and most convenient solution for business owners. Clearway Enforcement offers businesses a no up-front cost debt recovery service undertaking pre-legal debt recovery on a No Collection – No Fee Service.

How Clearway support clients through the stages of debt management and recovery

Clearway and our partners fully understand the costs and management time and effort that require to be invested in debt management and recovery – and we are here to support your business needs at all stage of the process. The typical stages are set out as follows, illustrating where Clearway can offer support.

Subject to terms between you and the defaulter, we can recover our fees from them as part of the recovery action.

In conclusion, Clearway’s team have a combined 30 years’ plus experience in UK debt collection, international debt recovery and tracing businesses and directors. Our clearVIEWbi interface and our pre-legal debt recovery service can provide valuable support to Scottish Engineering members that are seeking to manage their debt profile more effectively and find fast, cost-effective, and reliable means to recover debts without legal fees.

Want to know more? Contact our Scottish Senior Client Director – Neil.Millar@theclearwaygroup.co.uk

The Scottish Government helps to fund organisations to give free debt advice. You can get advice by phone, online or face to face. Phone and online debt advice Advice Direct Scotland Phone: 0808 196 2316 Data Sources

Company insolvency data were sourced from Companies House, except for compulsory liquidation data for England and Wales which were sourced from the Insolvency Service administrative systems.Users Guide to the Late Payment Directive.Office for National StatisticsGovscot