The forecast for prices quantifies the feedback of members that raw material and component cost increases have unfortunately stayed with us and there is no clarity that they are stabilising yet, with energy costs also now a significant concern.

Staffing intent remains positive and within a few points of last quarter, and once again we listen to member feedback of the challenge of actually filling the vacancies where they seek to hire additional roles. More than ever this has proven difficult as all resources become increasingly scarce, and the impacts of Brexit – still far from done - are evident in staffing, logistics and concern that import checks scheduled for the New Year may bring further headaches.

Key attention points from this quarter:

- Order intake, Output Volume, Exports at their most positive since 2018

- Staffing intentions remain close to recent best at net 17% positive

- Order intake for the last 3 months up 35%, with same forecast outlook for next 3 months

- UK and Export forecast prices reflect continued raw material and component price increases with net 57% and 58% increased respectively for small companies

The data in this Review were acquired by a survey of Scottish Engineering’s members and certain other manufacturing companies.

25% of members responded

Companies are described as:

Small (<100 employees), Medium (100–500) and Large (>500)

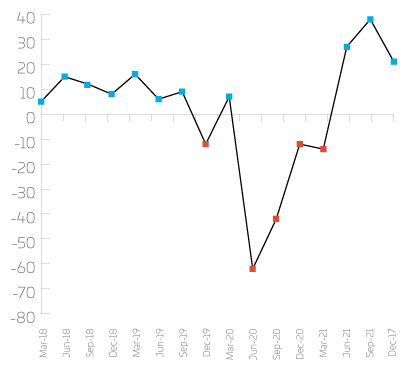

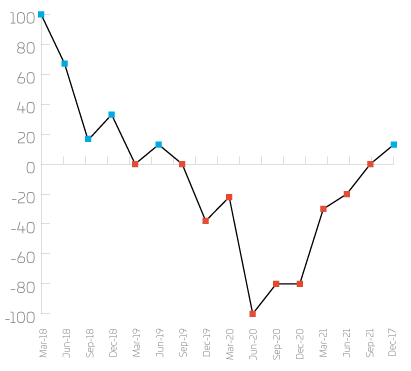

Annual trends

Order intake, output volume and exports have all further improved since last quarter, whilst staffing remains positive albeit at a slightly reduced rate. Exports increases its positive path quarter on quarter by a further 7 percentage points.

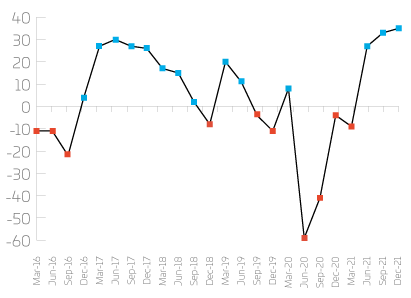

Order intake

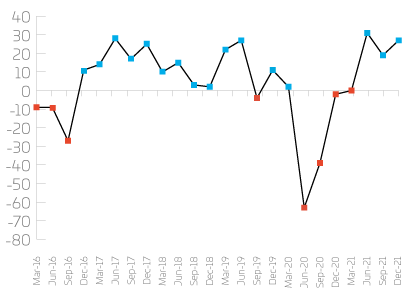

Output volume

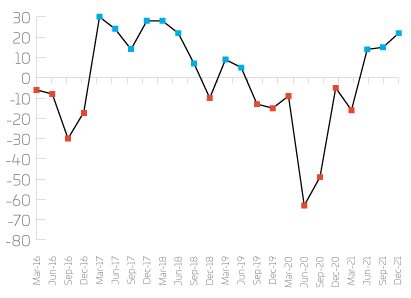

Exports

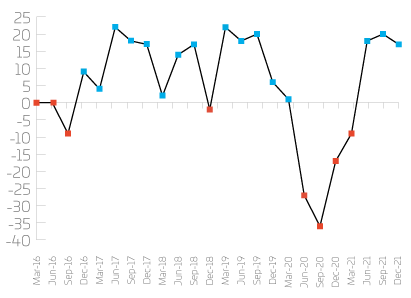

Staffing

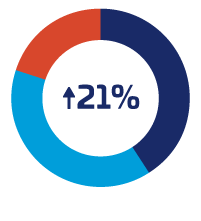

UK Orders

Net | Up | Same | Down |

21% | 41% | 39% | 20% |

UK orders have remained positive, with the balance of change at 21% (6 percentage points less than last quarter). All sizes of company are reporting increases, with the majority of sectors reporting positive or equal numbers of increases and decreases. Electronics recorded a decrease with the balance of change at -14%.

Companies | Net | Up | Same | Down |

Small | 15% | 40% | 35% | 25% |

Medium | 37% | 47% | 42% | 11% |

Large | 25% | 25% | 75% | 0% |

Sectors |

|

|

|

|

Machine | 0% | 25% | 50% | 25% |

Mechanical | 19% | 42% | 35% | 23% |

Metal | 50% | 50% | 50% | 0% |

Non-metal | 75% | 75% | 25% | 0% |

Fabricators | 33% | 56% | 22% | 22% |

Electronics | -14% | 14% | 57% | 29% |

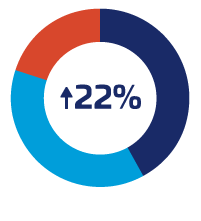

Export Orders

Net | Up | Same | Down |

22% | 42% | 38% | 20% |

Export orders have also remained positive this quarter, with the balance of change at 22%. All sizes of company are reporting increases, the balance of change is 17% for small companies, 31% for medium companies, and 33% for large companies. Most sectors are positive; the balance of change is 75% for non-metal products, 40% for machine shops, 30% for mechanical equipment; metal manufacturing and electronics are reporting equal numbers of increases and decreases; and fabricators are reporting a decrease of -40%.

Companies | Net | Up | Same | Down |

Small | 17% | 39% | 39% | 22% |

Medium | 31% | 50% | 31% | 19% |

Large | 33% | 33% | 67% | 0% |

Sectors |

|

|

|

|

Machine | 40% | 40% | 60% | 0% |

Mechanical | 30% | 48% | 35% | 17% |

Metal | 0% | 33% | 34% | 33% |

Non-metal | 75% | 75% | 25% | 0% |

Fabricators | -40% | 0% | 60% | 40% |

Electronics | 0% | 33% | 34% | 33% |

Optimism

Net | Up | Same | Down |

19% | 35% | 49% | 16% |

Optimism has remained positive, with the balance of change at 19%. All sizes of company are reporting positive returns: small companies 12%, medium companies 29% and large companies 50%. Across the sectors it’s a similar scene, with all sectors reporting positive returns or equal numbers of increases and decreases.

Companies | Net | Up | Same | Down |

Small | 12% | 32% | 48% | 20% |

Medium | 29% | 38% | 52% | 10% |

Large | 50% | 50% | 50% | 0% |

Sectors |

|

|

|

|

Machine | 25% | 50% | 25% | 25% |

Mechanical | 30% | 37% | 56% | 7% |

Metal | 25% | 50% | 25% | 25% |

Non-metal | 25% | 25% | 75% | 0% |

Fabricators | 11% | 33% | 45% | 22% |

Electronics | 0% | 25% | 50% | 25% |

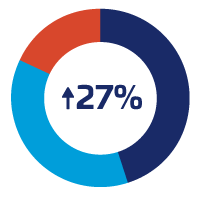

Output Volume

Net | Up | Same | Down |

27% | 45% | 37% | 18% |

Output volume remains positive with the balance of change at 27%. All sizes of company are positive, and across the sectors all returns are positive.

Companies | Net | Up | Same | Down |

Small | 18% | 43% | 33% | 24% |

Medium | 40% | 45% | 50% | 5% |

Large | 75% | 75% | 25% | 0% |

Sectors |

|

|

|

|

Machine | 13% | 38% | 37% | 25% |

Mechanical | 33% | 48% | 37% | 15% |

Metal | 25% | 50% | 25% | 25% |

Non-metal | 50% | 50% | 50% | 0% |

Fabricators | 22% | 44% | 34% | 22% |

Electronics | 38% | 50% | 37% | 13% |

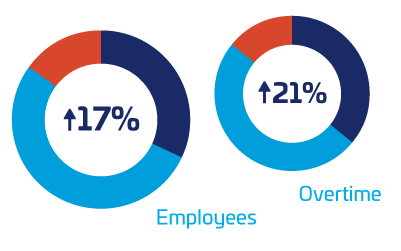

Staffing

Net | Up | Same | Down |

17% | 32% | 53% | 15% |

Employee numbers are positive for all sizes of company, and all sectors. Non-metal products are reporting the biggest increases at 75%.

Companies | Net | Up | Same | Down |

Small | 2% | 18% | 66% | 16% |

Medium | 48% | 57% | 33% | 10% |

Large | 50% | 75% | 0% | 25% |

Sectors |

|

|

|

|

Machine | 13% | 13% | 87% | 0% |

Mechanical | 11% | 26% | 59% | 15% |

Metal | 25% | 25% | 75% | 0% |

Non-metal | 75% | 75% | 25% | 0% |

Fabricators | 22% | 44% | 34% | 22% |

Electronics | 25% | 38% | 49% | 13% |

Overtime

Overtime working is similar to last quarter, with all sizes of company reporting increases.

Companies | Net | Up | Same | Down |

21% | 36% | 50% | 14% | |

Small | 17% | 30% | 57% | 13% |

Medium | 30% | 50% | 30% | 20% |

Large | 25% | 25% | 75% | 0% |

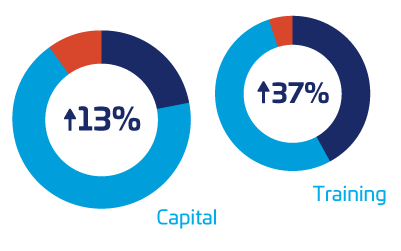

Investment

Net | Up | Same | Down |

13% | 22% | 68% | 10% |

Capital investment plans are down 4 percentage points since last quarter: although all sizes of company are reporting positive returns. Across the sectors non-metal products, mechanical equipment, and electronics are reporting a positive balance of change; machine shops and metal manufacturing are reporting equal numbers of increases and decreases, and fabricators are reporting a balance of change of -25%.

Companies | Net | Up | Same | Down |

Small | 10% | 23% | 64% | 13% |

Medium | 15% | 20% | 75% | 5% |

Large | 25% | 25% | 75% | 0% |

Sectors |

|

|

|

|

Machine | 0% | 25% | 50% | 25% |

Mechanical | 12% | 19% | 73% | 8% |

Metal | 0% | 0% | 100% | 0% |

Non-metal | 50% | 50% | 50% | 0% |

Fabricators | -25% | 0% | 75% | 25% |

Electronics | 14% | 14% | 86% | 0% |

Training Investment

All sizes of company are reporting increases in training investment.

Companies | Net | Up | Same | Down |

37% | 42% | 53% | 5% | |

Small | 35% | 42% | 52% | 6% |

Medium | 38% | 43% | 52% | 5% |

Large | 50% | 50% | 50% | 0% |

Capacity Utilisation

Capacity utilisation has decreased 17 percentage points since last quarter.

Order Intake Total: Machine Shops

Machine Shops order intake is positive for the first time since June 2019.

Forecast

Looking to the next 3 months, forecasts are good, with all measures positive. The net balance of change for overall orders is 26%, UK orders 23%, export orders 27% and output volume 22%. All sizes of company are forecasting positive figures for UK order intake, order export, UK prices, export prices, output volume and employee numbers; and across most sectors all measurements are positive, the only sectors forecasting decreases are electronics for UK order intake and fabricators for export orders.

| Net | Up | Same | Down | |

Orders | 26% | 46% | 34% | 20% |

UK Orders | 23% | 39% | 44% | 17% |

Export Orders | 27% | 40% | 47% | 13% |

Output Volume | 22% | 42% | 37% | 21% |

Balance of change %

| Order Intake UK | Orders Export | Prices UK | Prices Export | Output Volume | Employees | |

|---|---|---|---|---|---|---|

| Small | 17 | 22 | 57 | 58 | 20 | 38 |

| Medium | 32 | 31 | 50 | 31 | 20 | 19 |

| Large | 50 | 67 | 0 | 33 | 50 | 75 |

| Metal Manufacturing | 25 | 33 | 75 | 67 | 50 | 50 |

| Non-Metal Products | 50 | 50 | 75 | 75 | 50 | 75 |

| Electronics | -14 | 17 | 14 | 17 | 13 | 50 |

| Fabricators | 0 | -20 | 89 | 80 | 0 | 22 |

| Machine Shops | 38 | 20 | 50 | 40 | 13 | 25 |

| Mechanical Equipment | 27 | 35 | 42 | 39 | 37 | 33 |