Increasing interest rates appear to have slowed construction activity, but a return to a more ‘normal’ or pre-covid holiday profile for the year has been suggested as an influence to consider too.

Key attention points from this quarter:

- Order intake amongst members fell to a balance of negative 10% from positive 26% last quarter, evenly distributed among UK and Export orders

- Output Volume remained net positive at 11%, down from a net balance of 35% with an overall increase last quarter

- For the coming three months, members forecast a net increase of 24% of businesses having increased orders, strongest for UK orders by a ratio of 2:1 versus exports

- Optimism overall holds positive at a balance of 11%, represented by 28% up, 56% same and 16% down

The data in this Review were acquired by a survey of Scottish Engineering’s members and certain other manufacturing companies.

35% of members responded

Companies are described as:

Small (<100 employees), Medium (100–500) and Large (>500)

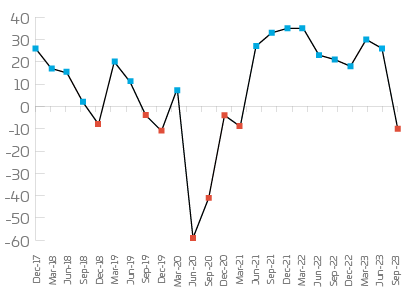

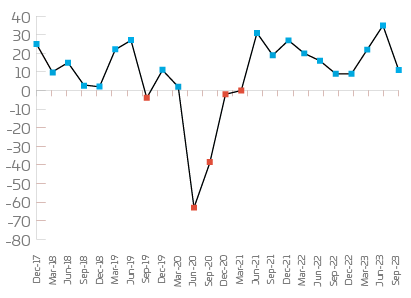

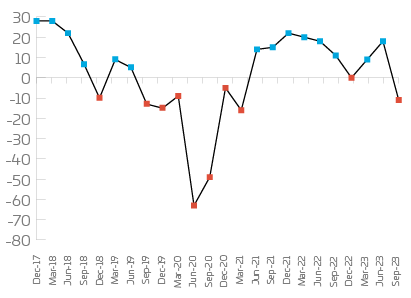

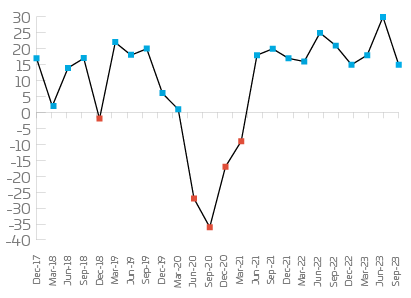

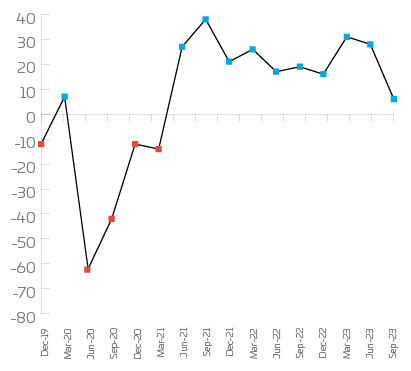

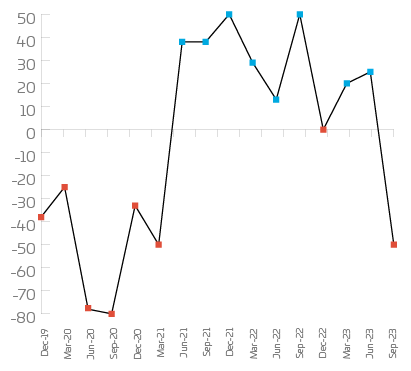

Annual trends

Order intake has, for the first time since March 2021, shown a net decrease of -10%, a drop of 36 percentage points since last quarter. Similarly, exports have also seen a notable decline in the same period, with a net decrease of -11% overall, a decline from last quarter of 29 percentage points. Output volume and staffing remain positive at +11% and +15% respectively however lower than last quarter’s results by -24% and -15%. These decreases match the dip in demand; however, optimism remains generally high in line with forecasts. Capacity utilisation remains positive this quarter at a net 6%, however another significant decline from last quarter’s 28%.

Order intake

Output volume

Exports

Staffing

UK Orders

Net | Up | Same | Down |

-12% | 22% | 44% | 34% |

UK orders have declined for small companies at -17% this quarter with large companies at -25%, a decline for the second quarter running. Medium companies remain static on last quarter. The majority of sectors have seen a sharp decline in order intake ranging from -20% to -60%, with plant and machinery remaining positive at 8%, up on last quarter (0%). Electrical & Electronics remain static at a 0% balance of change.

Companies | Net | Up | Same | Down |

Small | -17% | 19% | 45% | 36% |

Medium | 0% | 27% | 46% | 27% |

Large | -25% | 25% | 25% | 50% |

Sectors |

|

|

|

|

Manufacturing | -36% | 8% | 48% | 44% |

Plant & Machinery | 8% | 23% | 62% | 15% |

Metal | -60% | 0% | 40% | 60% |

Precision | -20% | 20% | 40% | 40% |

Fabricators | -23% | 23% | 31% | 46% |

Electrical & Electronics | 0% | 29% | 42% | 29% |

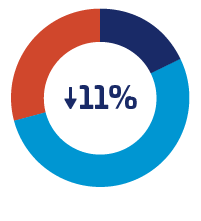

Export Orders

Net | Up | Same | Down |

-11% | 18% | 53% | 29% |

Export orders for small, medium and larger companies have declined this quarter at 10%, -12% and -25% with larger companies reporting a decline for a consecutive quarter. Precision Engineering records a positive balance of change of 15%, an improvement from last quarter (-20%) however, Manufacturing, Fabricators and Electrical & Electronics all show a decline of -35%, -33% and -14%. Overall, exports show a decrease from 18% to -11% overall for all sizes and sectors.

Companies | Net | Up | Same | Down |

Small | -10% | 17% | 56% | 27% |

Medium | -12% | 19% | 50% | 31% |

Large | -25% | 25% | 25% | 50% |

Sectors |

|

|

|

|

Manufacturing | -35% | 10% | 45% | 45% |

Plant & Machinery | 0% | 22% | 56% | 22% |

Metal | -33% | 0% | 67% | 33% |

Precision | 15% | 29% | 57% | 14% |

Fabricators | -25% | 0% | 75% | 25% |

Electrical & Electronics | -14% | 29% | 28% | 43% |

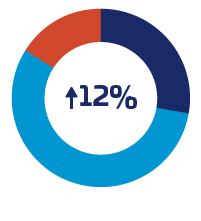

Optimism

Net | Up | Same | Down |

12% | 28% | 56% | 16% |

Optimism remains positive with a net 11% of companies showing increased outlook although lower than last quarter’s 24 percentage points. Larger companies are showing the least optimism with a balance of change of -25%. Most sectors remain positive in their outlook, with precision Engineering and Electrical & Electronics showing the strongest net optimism with +30% and +25% respectively. Metal Products and Fabricators show a negative net outlook at -16% and -7% respectively, a shift on last quarter for Fabricators from +27%. Electrical & Electronics have shown the most optimism in their outlook moving from -33% to 25%.

Companies | Net | Up | Same | Down |

Small | 12% | 29% | 54% | 17% |

Medium | 12% | 24% | 64% | 12% |

Large | -25% | 25% | 25% | 50% |

Sectors |

|

|

|

|

Manufacturing | 8% | 31% | 46% | 23% |

Plant & Machinery | 8% | 23% | 62% | 15% |

Metal | -16% | 17% | 50% | 33% |

Precision Engineering | 30% | 30% | 70% | 0% |

Fabricators | -7% | 14% | 65% | 21% |

Electrical & Electronics | 25% | 38% | 49% | 13% |

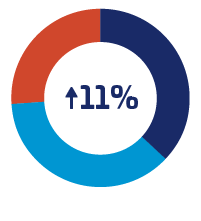

Output Volume

Net | Up | Same | Down |

11% | 37% | 37% | 26% |

Output volume remains positive this quarter at 11%, lower than last quarter (35%). Small and medium companies remain positive at +4% and +26%, while larger companies are a flat return this quarter. Precision engineering for the second quarter running shows the strongest net increase at +30% improvement, with Plant & Machinery, Metal Products and Fabricators all showing a decline of -15%, -16% and -22% respectively. Electrical & Electronics show equal positive and negative returns this quarter.

Companies | Net | Up | Same | Down |

Small | 4% | 33% | 38% | 29% |

Medium | 26% | 44% | 38% | 18% |

Large | 0% | 50% | 0% | 50% |

Sectors |

|

|

|

|

Manufacturing | 8% | 35% | 38% | 27% |

Plant & Machinery | -15% | 23% | 39% | 38% |

Metal | -16% | 17% | 50% | 33% |

Precision | 30% | 50% | 30% | 20% |

Fabricators | -22% | 21% | 36% | 43% |

Electrical & Electronics | 0% | 38% | 24% | 38% |

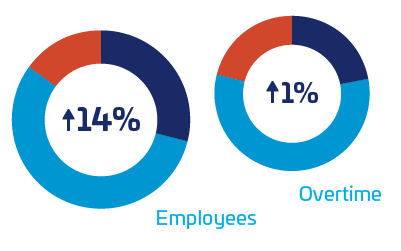

Staffing

Net | Up | Same | Down |

14% | 29% | 56% | 15% |

Employee numbers are positive for all size of companies, small (+14%), medium (+14%) and large (+25%). Fabricators indicate the wider challenges showing in this report for the sector with a staffing decline of -29%.

Companies | Net | Up | Same | Down |

Small | 14% | 29% | 56% | 15% |

Medium | 14% | 26% | 62% | 12% |

Large | 25% | 50% | 25% | 25% |

Sectors |

|

|

|

|

Manufacturing | 23% | 27% | 69% | 4% |

Plant & Machinery | 0% | 15% | 70% | 15% |

Metal | 17% | 33% | 50% | 17% |

Precision | 30% | 50% | 30% | 20% |

Fabricators | -29% | 7% | 57% | 36% |

Electrical & Electronics | 37% | 50% | 37% | 13% |

Overtime

Overtime working is broadly similar to last quarter with larger companies reporting the largest decline at -25% followed by smaller companies at -1% and this matches the decline in both UK and Export orders this quarter combined with smaller and medium companies increasing employee numbers this quarter.

Companies | Net | Up | Same | Down |

1% | 22% | 57% | 21% | |

Small | -1% | 18% | 63% | 19% |

Medium | 8% | 29% | 50% | 21% |

Large | -25% | 25% | 25% | 50% |

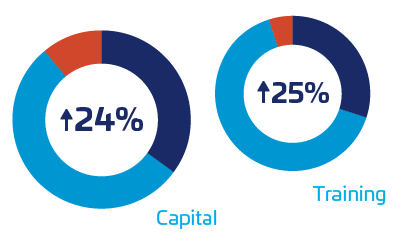

Investment

Net | Up | Same | Down |

24% | 35% | 54% | 11% |

Capital investment plans remain positive overall with all sizes of companies and the majority of sectors reporting positive returns. Larger and smaller companies are jointly reporting the largest increases with a net +25% balance of change with medium sized not far behind at +21%. Electrical & Electronics are the most optimistic with investment plans at +88% followed by Metal Products (40%) and Fabricators (17%). Both Plant & Machinery and Precision Engineering report equal positive and negative returns on last quarter.

Companies | Net | Up | Same | Down |

Small | 25% | 36% | 53% | 11% |

Medium | 21% | 30% | 61% | 9% |

Large | 25% | 50% | 25% | 25% |

Sectors |

|

|

|

|

Manufacturing | 15% | 15% | 85% | 0% |

Plant & Machinery | 0% | 27% | 46% | 27% |

Metal | 40% | 60% | 20% | 20% |

Precision | 0% | 20% | 60% | 20% |

Fabricators | 17% | 33% | 50% | 17% |

Electrical & Electronics | 88% | 88% | 12% | 0% |

Training Investment

Reflecting the skills challenges across industry, all sizes of companies are reporting increased plans for training investment, with larger companies strongest with a net 50% of these companies reporting increased training plans. Small and medium sized companies also show positive net increases of +28% and +15% respectively.

Companies | Net | Up | Same | Down |

25% | 30% | 65% | 5% | |

Small | 28% | 35% | 58% | 7% |

Medium | 15% | 18% | 79% | 3% |

Large | 50% | 0% | 50% | 50% |

Capacity Utilisation

Capacity utilisation remains positive with 6% of companies reporting that they are at full capacity, a decrease of 22% compared to last quarter.

Metal products

Metal Products order intake has been impacted substantially this quarter with a significant decrease from +25% to -50%, a decrease seen since quarter 1 of 2021, and is in line with the reduction in employees from 36% last quarter to -29% this quarter.

Forecast

Looking at the next 3 months, forecasts remain broadly positive for most company sizes and sectors, however Metal Products foresee a further downward trajectory next quarter in two key areas – a reduction in employees at -33% and order export at -20%. Medium sized companies are showing the highest for order intake (+42%) with Precision Engineering not far behind with a forecast of +30%. Electrical & Electronics show the largest planned increase in employees (+63%) despite modest UK increases and flat export orders for the coming quarter and Metal Products have forecast the highest increase in Prices UK (+50%).

| Net | Up | Same | Down | |

Orders | 24% | 39% | 46% | 15% |

UK Orders | 22% | 37% | 48% | 15% |

Export Orders | 11% | 24% | 63% | 13% |

Output Volume | 27% | 40% | 47% | 13% |

Balance of change %

| Order Intake UK | Orders Export | Prices UK | Prices Export | Output Volume | Employees | |

|---|---|---|---|---|---|---|

| Small | 14 | 10 | 19 | 12 | 22 | 22 |

| Medium | 42 | 15 | 24 | 33 | 41 | 18 |

| Large | 0 | 0 | 25 | 0 | 0 | 25 |

| Metal Products | 25 | -20 | 50 | 20 | 20 | -33 |

| Precision Engineering | 30 | 29 | 20 | 38 | 30 | 30 |

| Electrical & Electronics | 14 | 0 | 13 | 0 | 29 | 63 |

| Fabricators | 23 | 33 | 21 | 0 | 15 | 7 |

| Manufacturing | 24 | 15 | 24 | 19 | 31 | 27 |

| Plant & Machinery | 8 | 22 | 15 | 44 | 23 | 15 |