Orders and output continue to hold an overall positive position, but it’s no surprise that optimism has fallen flat for the first time in eighteen months as all businesses contemplate the impact of industrial energy pricing.

Key attention points from this quarter:

- Companies who have renewed or are currently renewing their Energy contract face an average increase of a 3.6 times multiplier

- One third of our survey respondents say that Energy prices put their business sustainability at risk

- Over half of our companies say energy prices will impact their investment plans; two thirds that it will be to the detriment of their competitiveness

- More than 60% of respondents say they will only be able to partially recover increased costs from energy pricing; almost one quarter will be unable to recover those increases at all

- Despite this, for a record sixth consecutive quarter, UK and Export orders and output are on balance positive yet again

The data in this Review were acquired by a survey of Scottish Engineering’s members and certain other manufacturing companies.

34% of members responded

Companies are described as:

Small (<100 employees), Medium (100–500) and Large (>500)

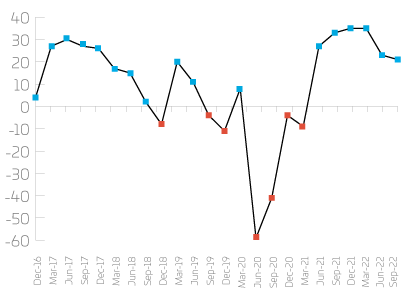

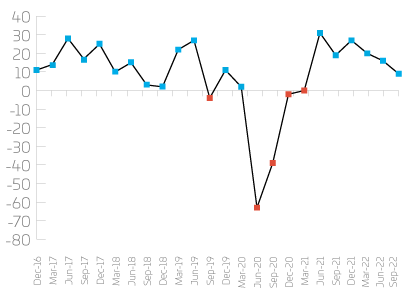

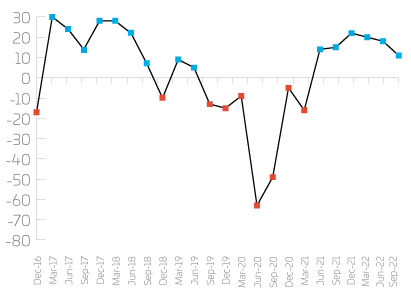

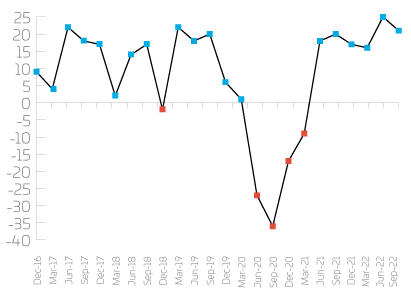

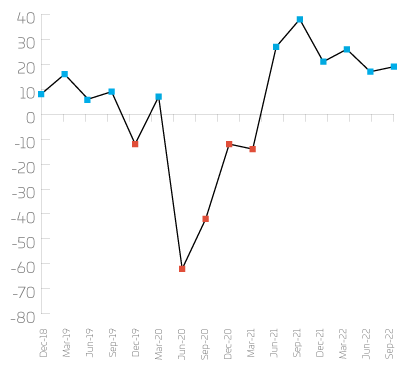

Annual trends

Order intake remained positive albeit at a slightly reduced level than recent quarters. Output volume and exports also remained positive although again at a marginally lower level than the previous quarter both with a balance change of -7% respectively. Staffing remained positive although softening by 4% with staffing remaining a priority within industry. The overall outlook from the data in third quarter shows a remarkable sixth straight quarter of positive indices, albeit somewhat softening, and optimism within the industry remains positive in comparison to 2020/21 overall.

Order intake

Output volume

Exports

Staffing

UK Orders

Net | Up | Same | Down |

15% | 39% | 37% | 24% |

UK orders continue with positivity across small and medium sized companies, larger companies are static with a 0% balance of change. Most sectors remain positive except for electronics where a net 50% of companies reported reductions. Metal Manufacturing show the most improvement, with net 50% reporting increased orders this quarter.

Companies | Net | Up | Same | Down |

Small | 15% | 39% | 37% | 24% |

Medium | 14% | 39% | 36% | 25% |

Large | 0% | 0% | 100% | 0% |

Sectors |

|

|

|

|

Machine | 0% | 29% | 42% | 29% |

Mechanical | 28% | 45% | 38% | 17% |

Metal | 50% | 67% | 16% | 17% |

Non-metal | 11% | 22% | 67% | 11% |

Fabricators | 8% | 23% | 62% | 15% |

Electronics | -50% | 17% | 16% | 67% |

Export Orders

Net | Up | Same | Down |

11% | 34% | 43% | 23% |

Export orders remain positive for small sized companies. Larger companies remain flat with an equal balance of companies gaining and falling, and medium companies show a slight decline with a balance of change of -5%. Non-metal products, electronics and fabricators are recording the most positive balance of changes at 29%, 20% and 11%. The overall balance of change has dropped slightly from 18% to 11% and following a slight reduction in the rate of increase.

Companies | Net | Up | Same | Down |

Small | 20% | 39% | 41% | 20% |

Medium | -5% | 23% | 50% | 27% |

Large | 0% | 50% | 0% | 50% |

Sectors |

|

|

|

|

Machine | 0% | 33% | 34% | 33% |

Mechanical | 4% | 25% | 54% | 21% |

Metal | 0% | 20% | 60% | 20% |

Non-metal | 29% | 43% | 43% | 14% |

Fabricators | 11% | 33% | 45% | 22% |

Electronics | 20% | 40% | 40% | 20% |

Optimism

Net | Up | Same | Down |

0% | 29% | 42% | 29% |

Optimism has understandably reached a static static position this quarter equal positive and negative returns. Metal manufacturing and machine shops show a negative return, with -67% and -57% respectively, whilst non-metal products show the strongest result with +11%. Larger companies remain positive reporting +50% whilst smaller companies are reporting the lowest with -3%.

Companies | Net | Up | Same | Down |

Small | -3% | 29% | 40% | 31% |

Medium | 4% | 29% | 46% | 25% |

Large | 50% | 50% | 50% | 0% |

Sectors |

|

|

|

|

Machine | -57% | 0% | 43% | 57% |

Mechanical | 10% | 30% | 50% | 20% |

Metal | -67% | 0% | 33% | 67% |

Non-metal | 11% | 33% | 45% | 22% |

Fabricators | 0% | 31% | 38% | 31% |

Electronics | 0% | 29% | 42% | 29% |

Output Volume

Net | Up | Same | Down |

9% | 36% | 37% | 27% |

Output volume remains positive at +9%. Small and medium companies are positive with larger companies flat overall. Most sectors remain positive or static except for fabricators reporting a balance of change of -23%.

Although output volume remains positive overall for sectors and size, the balance of change has dropped by 7% since last quarter, with medium companies reporting an increase from 4% to 7%. Smaller and larger companies have a balance of change reducing 9 and 33 percentage points respectively compared to last quarter but still remain positive. Machine shops are reporting a significant decline from 67% to 0%, whilst Non-metal products shows the greatest positivity, improving by 66 percentage points since last quarter.

Companies | Net | Up | Same | Down |

Small | 10% | 35% | 40% | 25% |

Medium | 7% | 36% | 35% | 29% |

Large | 0% | 50% | 0% | 50% |

Sectors |

|

|

|

|

Machine | 0% | 14% | 72% | 14% |

Mechanical | 7% | 33% | 40% | 27% |

Metal | 0% | 33% | 34% | 33% |

Non-metal | 22% | 44% | 34% | 22% |

Fabricators | -23% | 8% | 61% | 31% |

Electronics | 14% | 43% | 28% | 29% |

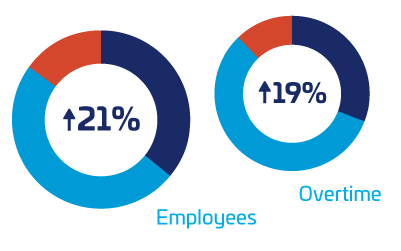

Staffing

Net | Up | Same | Down |

21% | 36% | 49% | 15% |

Employee numbers are positive for all sizes of company, and all sectors. Larger companies are reporting a 50% increase overall since last quarter followed by medium companies with +21% and smaller companies at +20%.

Companies | Net | Up | Same | Down |

Small | 20% | 35% | 51% | 14% |

Medium | 21% | 39% | 43% | 18% |

Large | 50% | 50% | 50% | 0% |

Sectors |

|

|

|

|

Machine | 43% | 43% | 57% | 0% |

Mechanical | 17% | 27% | 63% | 10% |

Metal | -33% | 17% | 33% | 50% |

Non-metal | 44% | 56% | 33% | 11% |

Fabricators | 8% | 38% | 31% | 31% |

Electronics | 14% | 29% | 57% | 14% |

Overtime

Overtime working is comparative to last quarter, with small companies reporting the largest increase for last two quarters. This may be reflective of the medium and larger companies increase in staffing, resulting in a decline in overtime, particularly in larger companies with a 0% balance of change with increase and decrease being the same.

Companies | Net | Up | Same | Down |

19% | 31% | 57% | 12% | |

Small | 23% | 32% | 59% | 9% |

Medium | 12% | 31% | 50% | 19% |

Large | 0% | 0% | 100% | 0% |

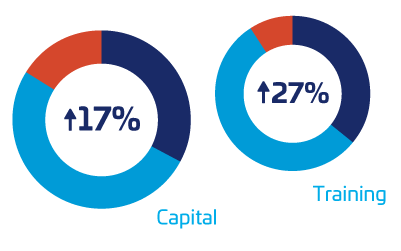

Investment

Net | Up | Same | Down |

17% | 33% | 51% | 16% |

Capital investment plans remain positive, with majority of sectors reporting positive returns. Metal manufacturing and electronics report a flat position at 0%, and overall, capital investment has increased to a net positive balance of 17%, an increase on last quarter on 1 percentage point.

Companies | Net | Up | Same | Down |

Small | 17% | 32% | 53% | 15% |

Medium | 14% | 32% | 50% | 18% |

Large | 50% | 50% | 50% | 0% |

Sectors |

|

|

|

|

Machine | 14% | 14% | 86% | 0% |

Mechanical | 7% | 28% | 51% | 21% |

Metal | 0% | 17% | 66% | 17% |

Non-metal | 22% | 33% | 56% | 11% |

Fabricators | 17% | 42% | 33% | 25% |

Electronics | 0% | 20% | 60% | 20% |

Training Investment

All sizes of company are reporting increases in training investment, however, this shows a lower rate of increase compared to last quarters positive balance of 32%.

Companies | Net | Up | Same | Down |

27% | 36% | 55% | 9% | |

Small | 30% | 37% | 56% | 7% |

Medium | 18% | 32% | 54% | 14% |

Large | 50% | 50% | 50% | 0% |

Capacity Utilisation

Capacity utilisation has decreased 9 percentage points to 17% since last quarter.

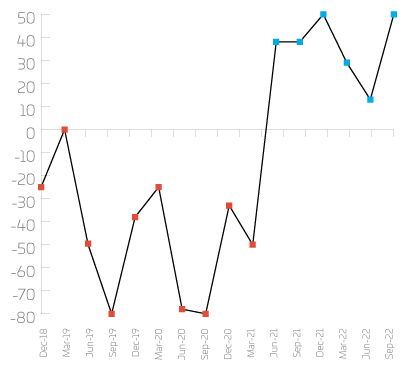

Order Intake Total: Metal Manufacturing

Metal manufacturing order intake has improved, after reporting 13% in second quarter to 50% in third quarter of 2022. After a slight decline in quarter two, their recovery is a welcome return of order rate after struggling in 2020/21.

Forecast

Looking at the next 3 months, forecasts remain positive for all company sizes with larger size companies showing the highest increases in all areas and in particular, UK prices, export prices, output volume and employees. The forecast change for overall orders is +22%, UK orders +14%, export orders +6% and output volume +34% showing positivity across all orders. There has been a decline in positivity since the last quarter for some sectors: Metal manufacturing with -67% in order intake and -80% in order exports, electronics at -17% in order intake, fabricators at -15% in order intake and -22% for order exports and machine shops at -14% order intake.

| Net | Up | Same | Down | |

Orders | 22% | 44% | 34% | 22% |

UK Orders | 14% | 38% | 38% | 24% |

Export Orders | 6% | 31% | 43% | 26% |

Output Volume | 34% | 48% | 38% | 14% |

Balance of change %

| Order Intake UK | Orders Export | Prices UK | Prices Export | Output Volume | Employees | |

|---|---|---|---|---|---|---|

| Small | 15 | 4 | 40 | 41 | 27 | 30 |

| Medium | 7 | 9 | 50 | 55 | 46 | 29 |

| Large | 50 | 0 | 100 | 100 | 100 | 100 |

| Metal Manufacturing | -67 | -80 | 0 | 0 | -33 | 0 |

| Non-Metal Products | 67 | 29 | 56 | 71 | 78 | 44 |

| Electronics | -17 | 0 | 57 | 40 | 43 | 29 |

| Fabricators | -15 | -22 | 31 | 33 | 8 | 23 |

| Machine Shops | -14 | -17 | 14 | 33 | -29 | 0 |

| Mechanical Equipment | 31 | 25 | 66 | 70 | 50 | 37 |