Staffing intention dropped further; however, optimism followed a similar pattern to orders and output, with the closest to balance responses in the last three quarters of negative returns. Training investment records its first negative index since December 2020, with small companies dipping negative in their plans for this key area for our sector.

Key attention points from this quarter:

- Overall order intake amongst members remained negative at a net -5% with export orders the stronger driver for reduction this quarter (and compared to -17% for this measure last quarter)

- Output volume also recorded a net negative return of -5%, compared to -20% for this metric last quarter

- Responding to the outlook for the proposed tariffs that the US administration is expected to place on the UK ( if in fact they are implemented):

- 52% of responding companies expect moderate direct impact if increased tariffs remain at the current or higher rate

- 18% of companies expect significant direct impact if increased tariffs remain at the current or higher rate

- 10% of companies see a potential upside from products moved to their Scottish operations vs 13% who see a potential downside from such moves

- 55% state that wider tariff impacts may provide an increase in raw material or component costs, while 41% expect pressure from customers to reduce pricing due to their impact from tariff changes

The data in this Review was acquired by a survey of Scottish Engineering’s members and certain other manufacturing companies.

28% of members responded

Companies are described as:

Small (<100 employees), Medium (100–500) and Large (>500)

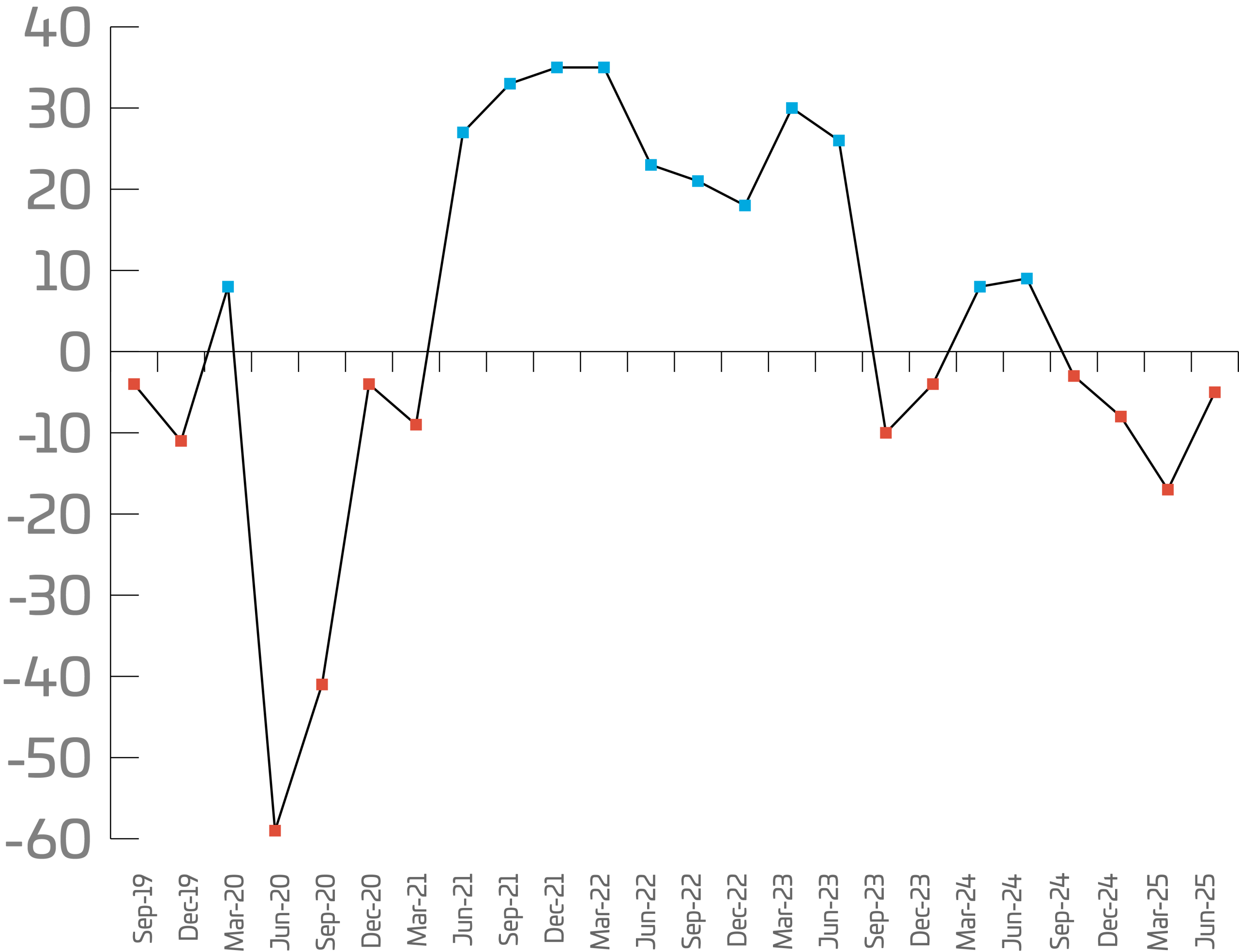

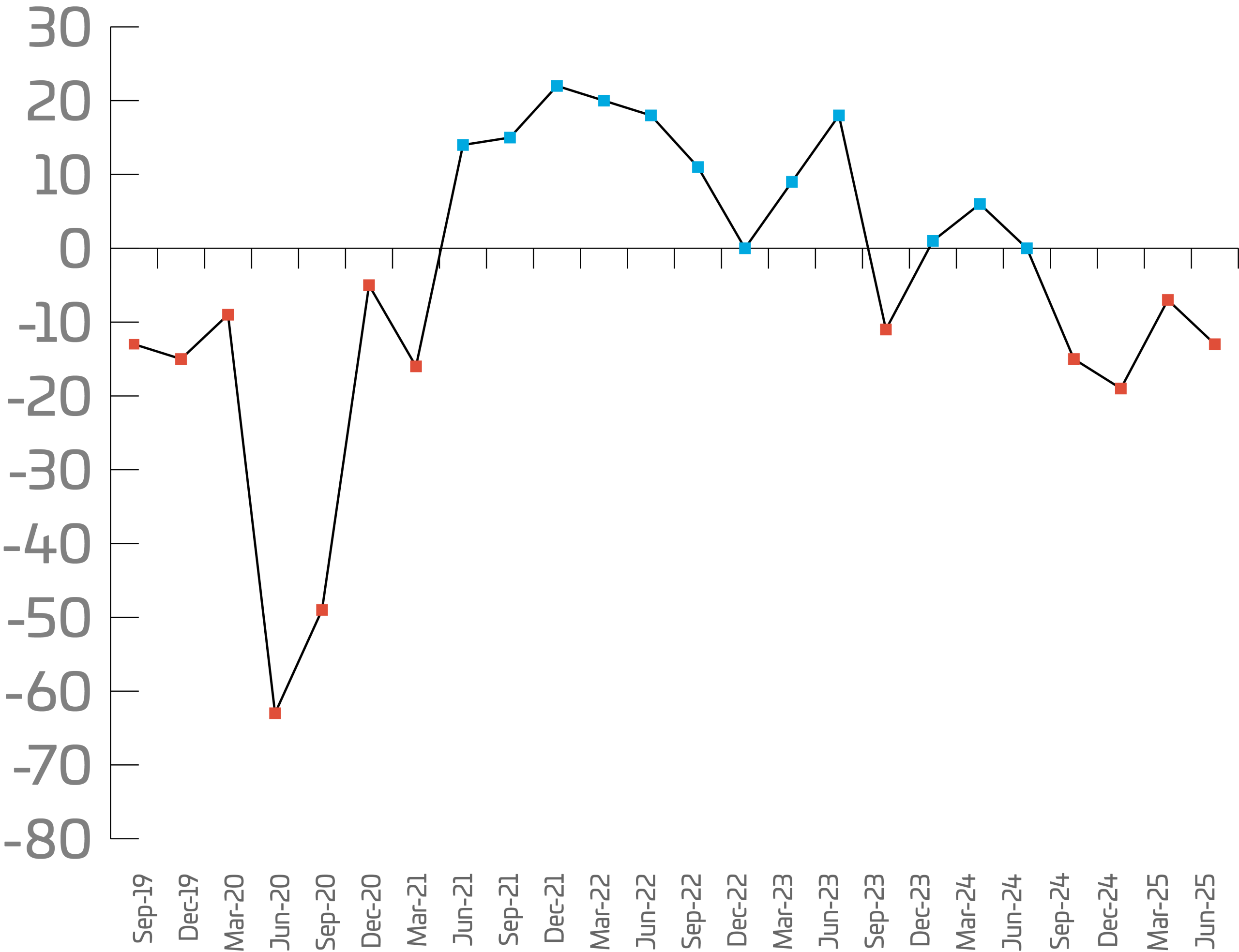

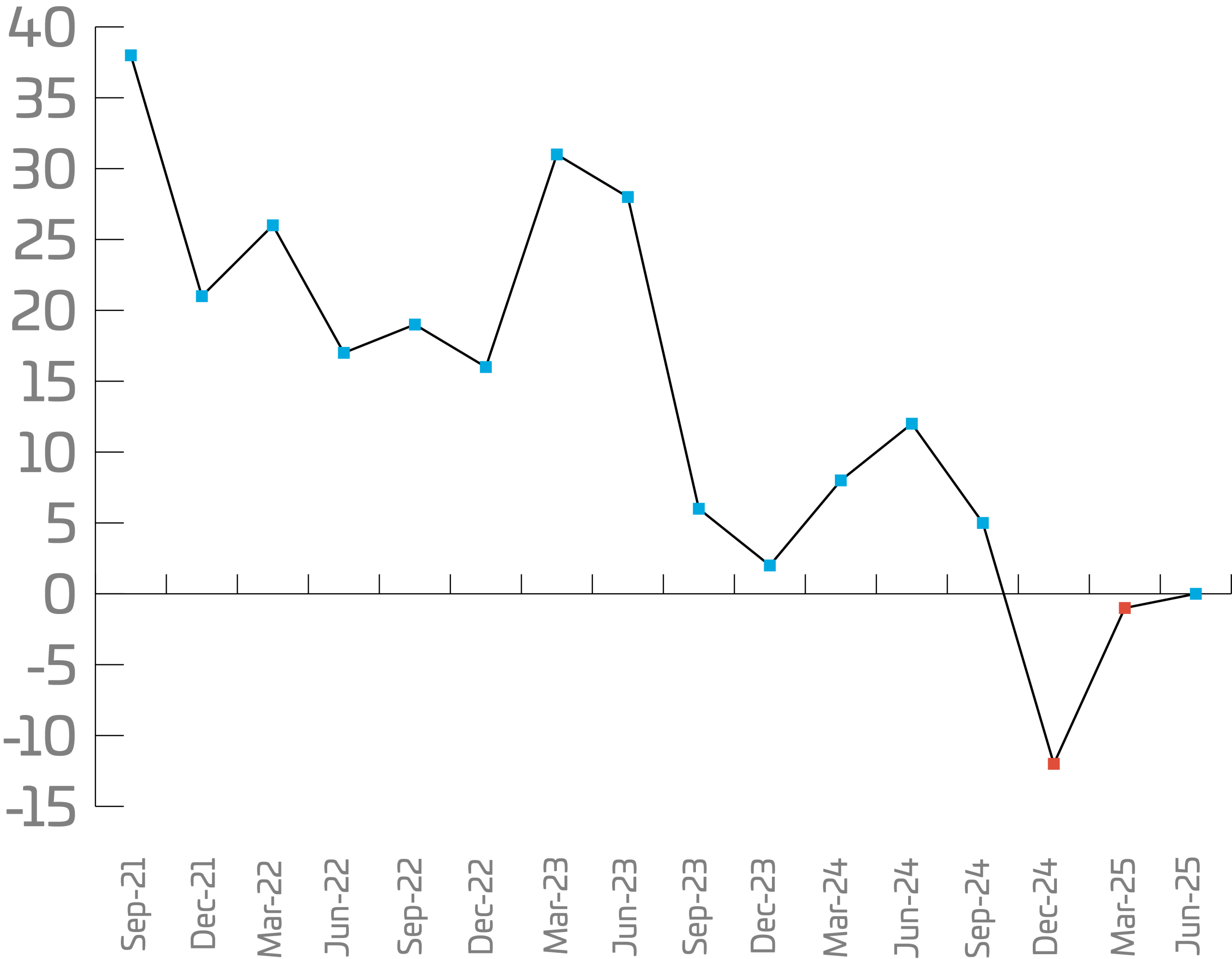

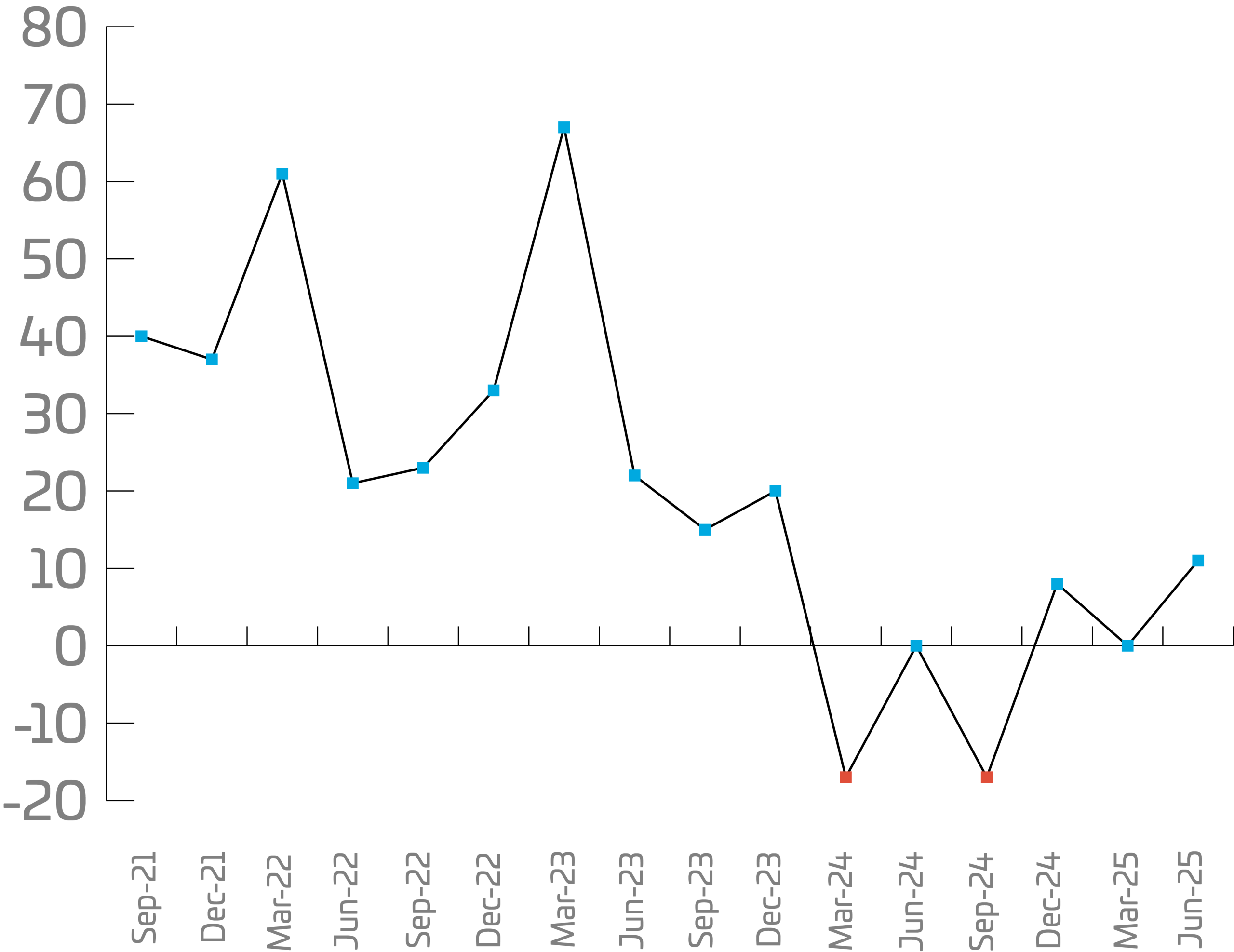

Annual trends

In the second quarter of 2025, order intake, output volume and exports declined for the fourth consecutive quarter, although order intake and output volume were both closer to a balanced position than the previous quarter. Intentions for staffing levels showed a continued negative trends compared to the previous quarter, with a net -10% compared to last quarter’s -4% intent. Capacity utilisation returned a balanced position at 0%, a slight improvement from the previous quarter.

Order intake

Output volume

Exports

Staffing

UK Orders

Net | Up | Same | Down |

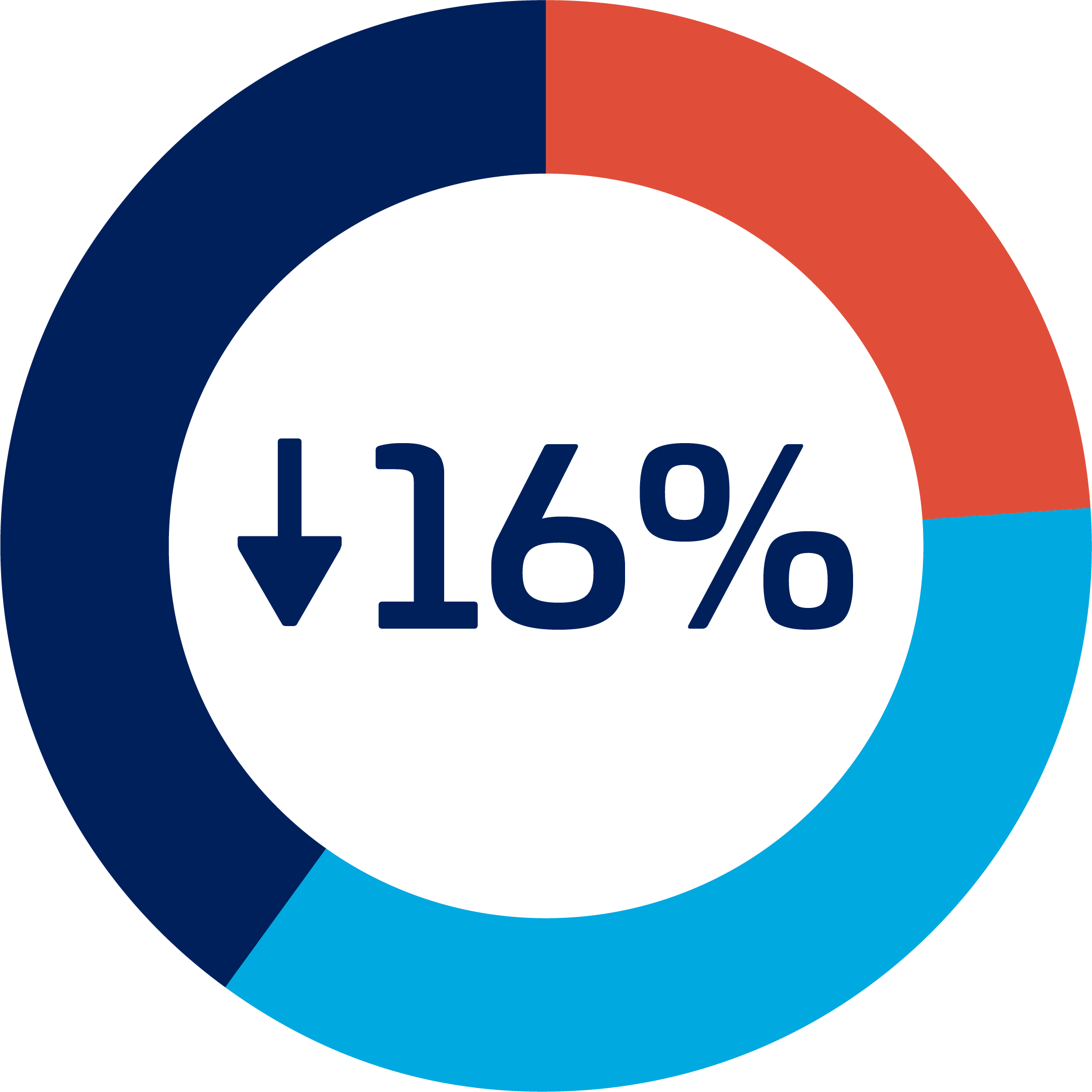

-16% | 24% | 36% | 40% |

UK orders remained negative for the fifth consecutive quarter, at a net -16%. Large companies contributed most significantly to the downturn, with their return falling to -50% from -34% last quarter. Small and medium-sized enterprises also reported negative results, at -17% and -6% respectively.

On a more positive note, Metal Products saw a strong recovery, improving from -80% to +25%. Precision Engineering also rebounded, rising from -40% to +16%, while Plant & Machinery moved from 0% to +11%.

Conversely, the Manufacturing sector posted a sharp decline, dropping to -46% from +4% last quarter—a significant downward shift. Although still negative, Fabricators and Electrical & Electronics showed modest improvements, with returns of -25% and -20% compared to -29% and -25% previously.

Companies | Net | Up | Same | Down |

| Small | -17% | 25% | 33% | 42% |

Medium | -6% | 27% | 40% | 33% |

Large | -50% | 0% | 50% | 50% |

Sectors |

|

|

|

|

Manufacturing | -46% | 11% | 32% | 57% |

Plant & Machinery | 11% | 33% | 45% | 22% |

Metal | 25% | 50% | 25% | 25% |

Precision | 16% | 54% | 8% | 38% |

Fabricators | -25% | 17% | 41% | 42% |

Electrical & Electronics | -20% | 20% | 40% | 40% |

Export Orders

Net | Up | Same | Down |

-13% | 24% | 39% | 37% |

Exports orders remain below the line for the fourth consecutive quarter with a net -13%. Medium and small sized companies have influenced this recording -25% and -12% respectively. Larger companies have recorded a positive balance this quarter at +16%. Precision Engineering indicate equal positive and negative returns this quarter as last quarter. All other businesses report negative returns – Metal Products -67%, Plant & Machinery -29%, Fabricators -25%, Electrical & Electronics -20% and Manufacturing -11%. Metal products, although recording negativity again this quarter has improved from -100% last quarter followed by Electrical & Electronics, improving from -25%.

Companies | Net | Up | Same | Down |

Small | -12% | 24% | 40% | 36% |

Medium | -25% | 21% | 33% | 46% |

Large | 16% | 33% | 50% | 17% |

Sectors |

|

|

|

|

Manufacturing | -11% | 31% | 27% | 42% |

Plant & Machinery | -29% | 0% | 71% | 29% |

Metal | -67% | 0% | 33% | 67% |

Precision | 0% | 33% | 34% | 33% |

Fabricators | -25% | 0% | 75% | 25% |

Electrical & Electronics | -20% | 20% | 40% | 40% |

Optimism

Net | Up | Same | Down |

-3% | 27% | 43% | 30% |

Optimism reported its third quarter of a negative index at -3%, with large and medium companies both positive, at +33% and +7% respectively. Small companies record a negative return of -11%, and whilst still negative this marks an improving trend over the last three quarters. Plant & Machinery and Fabricators show positive returns this quarter of +20% and +8% respectively, an upward trajectory for both on last quarter (0% and -40%). Most businesses recorded negativity this quarter – Metal Products (-75%), Precision Engineering (-30%), Manufacturing (-21%) and Electrical & Electronics (-20%).

Companies | Net | Up | Same | Down |

Small | -11% | 22% | 45% | 33% |

Medium | 7% | 37% | 33% | 30% |

Large | 33% | 33% | 67% | 0% |

Sectors |

|

|

|

|

Manufacturing | -21% | 18% | 43% | 39% |

Plant & Machinery | 20% | 50% | 20% | 30% |

Metal | -75% | 0% | 25% | 75% |

Precision Engineering | -30% | 8% | 54% | 38% |

Fabricators | 8% | 33% | 42% | 25% |

Electrical & Electronics | -20% | 20% | 40% | 40% |

Output Volume

Net | Up | Same | Down |

-5% | 32% | 31% | 37% |

Output volume, for the fourth consecutive quarter has seen a decline of a net -5%. Medium companies show both equal positive and negative returns, larger companies are reporting negative returns this quarter of -33%, and small companies record a decline of -4% this quarter. Plant & Machinery indicate equal positive and negative returns this quarter, Precision Engineering are recording the most positivity this quarter at +46%, Electrical & Electronics report a decline of -40%, and Manufacturing, Metal Products and Fabricators all reported a decline of -25%.

Companies | Net | Up | Same | Down |

Small | -4% | 32% | 32% | 36% |

Medium | 0% | 37% | 26% | 37% |

Large | -33% | 17% | 33% | 50% |

Sectors |

|

|

|

|

Manufacturing | -25% | 25% | 25% | 50% |

Plant & Machinery | 0% | 10% | 80% | 10% |

Metal | -25% | 25% | 25% | 50% |

Precision | 46% | 69% | 8% | 23% |

Fabricators | -25% | 17% | 41% | 42% |

Electrical & Electronics | -40% | 20% | 20% | 60% |

Staffing

Net | Up | Same | Down |

-10% | 17% | 55% | 28% |

Staffing intent has seen further decline this quarter to a net -10%. Small companies have affected this decline with a downward trajectory from -7% last quarter to -18%. Medium companies record both equal positive and negative returns this quarter whilst larger companies record positivity at +17% (a decline from +44%). Plant & Machinery and Metal products record both equal a positive and negative returns this quarter (+27% and -40% respectively last quarter). Electrical & Electronics, Manufacturing, Fabricators and Precision Engineering all show a decline of -60%, -18%, -17% & -8% respectively, all similar to last quarter.

Companies | Net | Up | Same | Down |

Small | -18% | 10% | 62% | 28% |

Medium | 0% | 27% | 46% | 27% |

Large | 17% | 50% | 17% | 33% |

Sectors |

|

|

|

|

Manufacturing | -18% | 14% | 54% | 32% |

Plant & Machinery | 0% | 20% | 60% | 20% |

Metal | 0% | 0% | 100% | 0% |

Precision | -8% | 15% | 62% | 23% |

Fabricators | -17% | 8% | 67% | 25% |

Electrical & Electronics | -60% | 0% | 40% | 60% |

Overtime

Overtime remains negative this quarter with medium companies reporting the largest decline from 0% to -11%. Smaller companies also show a decline this quarter of -16% compared to -21% the previous quarter. Larger companies show both equal positive and negative returns this quarter.

Companies | Net | Up | Same | Down |

-14% | 22% | 42% | 36% | |

Small | -16% | 22% | 40% | 38% |

Medium | -11% | 21% | 47% | 32% |

Large | 0% | 33% | 34% | 33% |

Investment

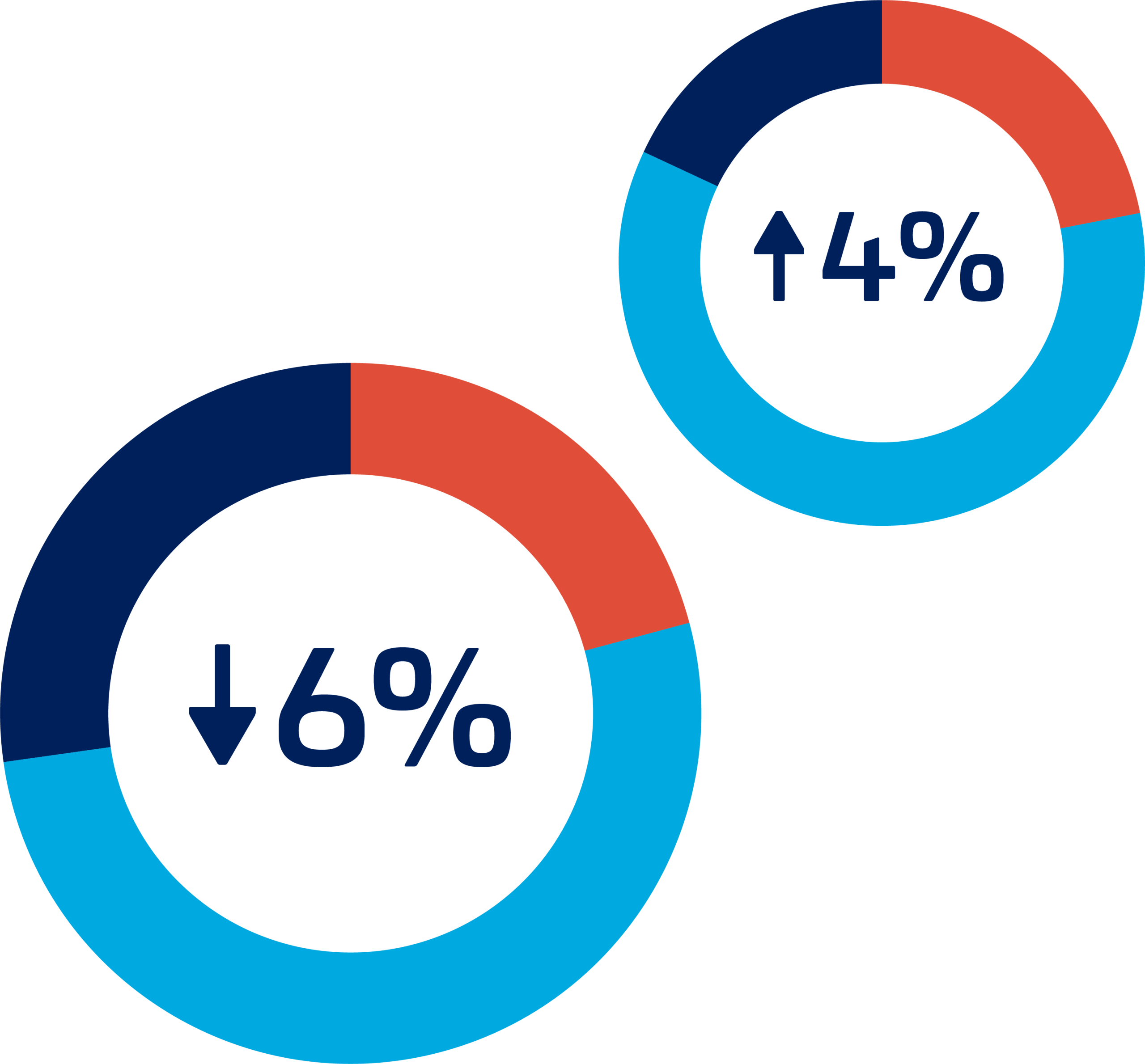

Net | Up | Same | Down |

-6% | 21% | 52% | 27% |

Capital investment plans have seen a decline this quarter of a net -6% after long term positive returns for this metric. Large and medium companies show positivity at +16% and +4% respectively with small companies recording negative returns of -12%. Electrical & Electronics, Precision Engineering, Metal Products and Manufacturing show negative returns at -40%, -30%, -25% and -7% whilst Fabricators and plant & Machinery are reporting equal positive and negative returns on last quarter.

Companies | Net | Up | Same | Down |

Small | -12% | 20% | 48% | 32% |

Medium | 4% | 21% | 62% | 17% |

Large | 16% | 33% | 50% | 17% |

Sectors |

|

|

|

|

Manufacturing | -7% | 25% | 43% | 32% |

Plant & Machinery | 0% | 22% | 56% | 22% |

Metal | -25% | 25% | 25% | 50% |

Precision | -30% | 8% | 54% | 38% |

Fabricators | 0% | 25% | 50% | 25% |

Electrical & Electronics | -40% | 0% | 60% | 40% |

Training Investment

Training investment remains positive; however it has moved closer to a flat return. Small companies are the driver of this shift, recording a negative return of -1% this quarter. Large and medium companies remain positive at +33% and +10%, similar to last quarter.

Companies | Net | Up | Same | Down |

4% | 22% | 60% | 18% | |

Small | -1% | 19% | 61% | 20% |

Medium | 10% | 24% | 62% | 14% |

Large | 33% | 50% | 33% | 17% |

Capacity Utilisation

Capacity Utilisation shows both equal positive and negative returns.

Plant & Machinery

Plant & Machinery are showing positivity this quarter at +11% on order intake (0% last quarter). Optimism has also improved this quarter at +20%, an improvement from 0%. Overall, Plant & Machinery forecasts the most positivity despite exports declining this quarter to -29%.

Forecast

Looking at the next 3 months, the majority of forecasts are positive and in particular for medium and large sized companies in all areas (Order Intake UK, Order Exports, Prices UK, Prices Export, Output Volume and Employees). Plant & Machinery forecast the most positivity in all areas (Order Intake UK (+33%), Orders Export (+71%), Prices UK (+44%), Prices Export (+50%), Output Volume (+40%) and Employees (+20%)). Large companies are seeing positivity overall in all areas too (Order Intake (+17%), Orders Export (+50%), Prices UK (+50%), Prices Export (+50%), Output Volume (+17%) and Employees ( +33%)). Metal products, Precision Engineering and Manufacturing are forecasting negativity for Order Exports at -67%, -22% and -4% respectively with Fabricators and Metal Products forecasting a decline in Order Intake UK at -45% and -25% respectively.

| Net | Up | Same | Down | |

Orders | 10% | 36% | 38% | 26% |

UK Orders | 3% | 28% | 47% | 25% |

Export Orders | 8% | 29% | 49% | 21% |

Output Volume | 12% | 34% | 44% | 22% |

Balance of change %

| Order Intake UK | Orders Export | Prices UK | Prices Export | Output Volume | Employees | |

|---|---|---|---|---|---|---|

| Small | -1 | 5 | 27 | 26 | 6 | 9 |

| Medium | 10 | 4 | 10 | 23 | 23 | 10 |

| Large | 17 | 50 | 50 | 50 | 17 | 33 |

| Metal Products | -25 | -67 | 0 | 0 | -75 | 0 |

| Precision Engineering | -8 | -22 | 15 | -11 | -8 | 15 |

| Electrical & Electronics | 0 | 40 | 20 | 20 | 20 | 0 |

| Fabricators | -45 | 0 | 8 | 25 | -25 | -17 |

| Manufacturing | 0 | -4 | 29 | 38 | 11 | -7 |

| Plant & Machinery | 33 | 71 | 44 | 50 | 40 | 20 |