Finding – and keeping – the right skills continue to be the challenge that occupies businesses the most, creating capacity restrictions where those skills are in short supply. No surprise then that once again training investment is up, and member’s responses to our questions on flexible working suggests that considerable movement has been made to aid staff retention.

Key attention points from this quarter:

- Almost 28% of companies have already implemented a compressed working week such as short Friday, 4-day week or 9 day fortnight, with a further 18% considering such a change

- 28% of responding companies allow shop floor employees to work flexibly accessing flexible start and finish times, banked and taken back hours

- Order intake was positive for a net 26% of members, with further recovery of exports at net 18% positive

- Output Volume was increased for 54% of companies, a net balance of 35% overall increased in the last quarter, with a forecast increase for 37% of businesses for a net 30% increase in the coming quarter

The data in this Review were acquired by a survey of Scottish Engineering’s members and certain other manufacturing companies.

29% of members responded

Companies are described as:

Small (<100 employees), Medium (100–500) and Large (>500)

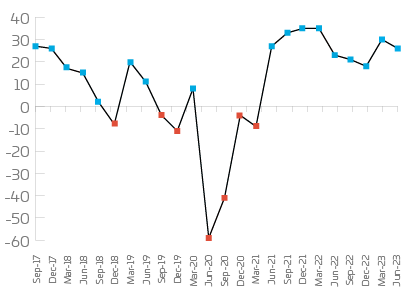

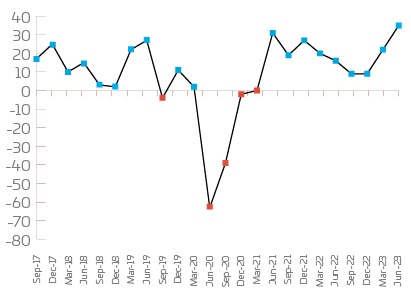

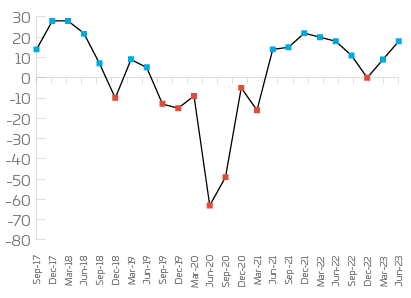

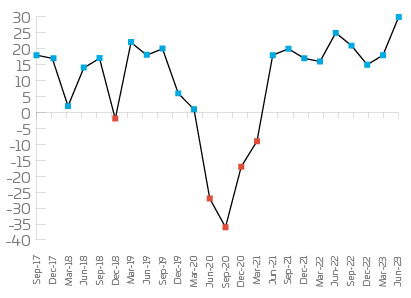

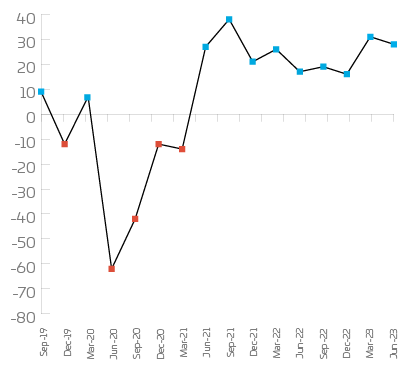

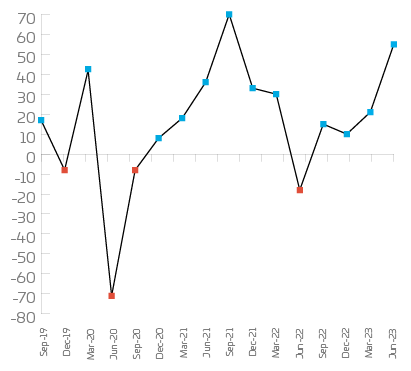

Annual trends

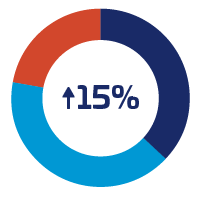

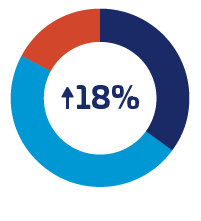

Order intake remains positive with a net 26% of companies increased against the previous quarter, and this joins output volume, exports and staffing as overall increased yet again. Exports show a welcome increase for the second quarter running, at 18% higher than the UK order net increase of 15%. 2023 continues its overall optimistic outlook, with wider second quarter data reflected in a net 21% increase in optimism, and whilst staffing intentions increased again (+12%) this emphasises the difficulties companies are still facing to recruit staff with the skills they seek. Output volume shows significant further positivity on last quarter (+35%) suggesting that the restrictions on materials are easing for companies, and capacity utilisation stays strong at a net 28%, a very slight decline from last quarter’s 31%.

Order intake

Output volume

Exports

Staffing

UK Orders

Net | Up | Same | Down |

15% | 37% | 41% | 22% |

UK orders remain positive for small and medium sized companies with medium sized companies showing, for the second quarter running, the strongest net increase at 31%. Smaller also companies show net positivity of 10%, however larger companies are reporting a net decline of -20% on UK orders, a 36% variance on last quarter. Most sectors remain positive, with fabricators recording a strong net increase of 70% and metal manufacturing showing a balance of change of 50% this quarter, with Electrical & Electronics companies at showing a net decline of -17%.

Companies | Net | Up | Same | Down |

| Small | 10% | 33% | 44% | 23% |

Medium | 31% | 50% | 31% | 19% |

Large | -20% | 20% | 40% | 40% |

Sectors |

|

|

|

|

Manufacturing | -4% | 30% | 36% | 34% |

Plant & Machinery | 0% | 22% | 56% | 22% |

Metal | 50% | 50% | 50% | 0% |

Precision | 25% | 37% | 51% | 12% |

Fabricators | 70% | 80% | 10% | 10% |

Electrical & Electronics | -17% | 0% | 83% | 17% |

Export Orders

Net | Up | Same | Down |

18% | 35% | 48% | 17% |

Exports orders for smaller companies has improved on last quarter by 23 percentage points, whilst larger companies are showing a significant decline with net -33%. Electrical & Electronics, Plant & Machinery, Metal Products and Manufacturing are recording positive balances of change of 50%, 33%, 25% and 14% respectively with Fabricators remaining static on last quarter. Precision engineering is the only sector showing a decline of net -20% and overall, the balance of change has increased from 9% to 18% showing positivity for most sizes and sectors.

Companies | Net | Up | Same | Down |

Small | 23% | 37% | 49% | 14% |

Medium | 14% | 36% | 42% | 22% |

Large | -33% | 0% | 67% | 33% |

Sectors |

|

|

|

|

Manufacturing | 14% | 27% | 60% | 13% |

Plant & Machinery | 33% | 50% | 33% | 17% |

Metal | 25% | 50% | 25% | 25% |

Precision | -20% | 20% | 40% | 40% |

Fabricators | 0% | 0% | 100% | 0% |

Electrical & Electronics | 50% | 50% | 50% | 0% |

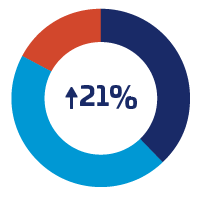

Optimism

Net | Up | Same | Down |

21% | 38% | 45% | 17% |

Optimism remains positive with a net 21% of companies stating increased outlook, and all sizes of companies are reporting net positivity with larger companies showing more net optimism with a balance of change of 20%. Most sectors remain positive in their outlook with Fabricators and Plant and Machinery showing the strongest net optimism with +27% and +22% respectively, however Electrical & Electronics show a negative net outlook for the third quarter in a row at -33%, and Metal products also show a net negative (-25%) after a positive return last quarter (20%).

Companies | Net | Up | Same | Down |

Small | 18% | 32% | 54% | 14% |

Medium | 30% | 48% | 34% | 18% |

Large | 20% | 60% | 0% | 40% |

Sectors |

|

|

|

|

Manufacturing | 20% | 40% | 40% | 20% |

Plant & Machinery | 22% | 33% | 56% | 11% |

Metal | -25% | 0% | 75% | 25% |

Precision Engineering | 0% | 25% | 50% | 25% |

Fabricators | 27% | 45% | 37% | 18% |

Electrical & Electronics | -33% | 17% | 33% | 50% |

Output Volume

Net | Up | Same | Down |

35% | 54% | 27% | 19% |

Output volume remains positive up to 35%. Small and medium companies are showing equal positivity at net 37% up, with larger companies showing equal positive and negative returns. Precision engineering shows the strongest net increase at +67% improvement, and all sectors show positivity apart from Electrical & Electronics, which reports a net flat overall position.

Companies | Net | Up | Same | Down |

Small | 37% | 55% | 27% | 18% |

Medium | 37% | 56% | 25% | 19% |

Large | 0% | 40% | 20% | 40% |

Sectors |

|

|

|

|

Manufacturing | 32% | 48% | 36% | 16% |

Plant & Machinery | 33% | 56% | 21% | 23% |

Metal | 25% | 50% | 25% | 25% |

Precision | 50% | 63% | 24% | 13% |

Fabricators | 45% | 64% | 17% | 19% |

Electrical & Electronics | 0% | 17% | 66% | 17% |

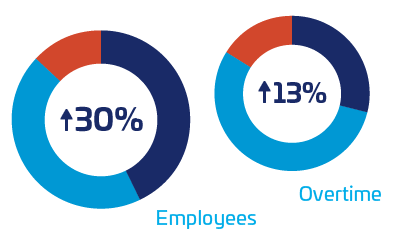

Staffing

Net | Up | Same | Down |

30% | 43% | 44% | 13% |

Employee numbers are positive for all sizes of companies, small (+23%), medium (+41%) and large (+60%). Electrical & Electronics reflect the wider challenges shown in this report for the sector with a staffing decline of -17%.

Companies | Net | Up | Same | Down |

Small | 23% | 39% | 45% | 16% |

Medium | 41% | 48% | 45% | 7% |

Large | 60% | 60% | 40% | 0% |

Sectors |

|

|

|

|

Manufacturing | 32% | 40% | 52% | 8% |

Plant & Machinery | 33% | 56% | 21% | 23% |

Metal | 0% | 25% | 50% | 25% |

Precision | 13% | 38% | 37% | 25% |

Fabricators | 36% | 36% | 64% | 0% |

Electrical & Electronics | -17% | 17% | 49% | 34% |

Overtime

Overtime working is broadly similar to last quarter, with medium companies reporting the largest increase for the second quarter running at 27%, smaller companies at 11% and larger companies a decline of -40%. Smaller and medium sized companies overtime increase may reflect the general trend in output, whilst for larger companies overtime declining would align with their strongly increased staffing (+60%) in the last quarter.

Companies | Net | Up | Same | Down |

13% | 29% | 55% | 16% | |

Small | 11% | 27% | 57% | 16% |

Medium | 27% | 38% | 51% | 11% |

Large | -40% | 0% | 60% | 40% |

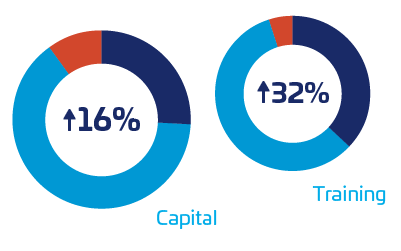

Investment

Net | Up | Same | Down |

16% | 26% | 64% | 10% |

Capital investment plans remain positive with all sizes of companies and sectors reporting positive returns. Larger companies are reporting the largest increase with a net +20% balance of change with medium and smaller companies indicating a net +19% and +15% respectively. Plant and Machinery are most optimistic with investment plans at +22% with Electrical & Electronics at +20%. Fabricators, Precision Engineering and Metal Products report equal positive and negative returns on last quarter.

Companies | Net | Up | Same | Down |

Small | 15% | 25% | 65% | 10% |

Medium | 19% | 26% | 67% | 7% |

Large | 20% | 40% | 40% | 20% |

Sectors |

|

|

|

|

Manufacturing | 20% | 28% | 64% | 8% |

Plant & Machinery | 22% | 33% | 56% | 11% |

Metal | 0% | 25% | 50% | 25% |

Precision | 0% | 0% | 100% | 0% |

Fabricators | 0% | 20% | 60% | 20% |

Electrical & Electronics | 20% | 40% | 40% | 20% |

Training Investment

Reflecting the skills challenges across industry, all sizes of companies are reporting increased plans for training investment, with larger companies strongest with a net 80% of these companies reporting increased training plans. Small and medium sized companies also show significant net increases of +26% and +37% respectively.

Companies | Net | Up | Same | Down |

32% | 37% | 58% | 5% | |

Small | 26% | 32% | 62% | 6% |

Medium | 37% | 41% | 55% | 4% |

Large | 80% | 80% | 20% | 0% |

Capacity Utilisation

Capacity utilisation remains strong with 28% of companies reporting that they are at full capacity, a decrease of 3% compared to last quarter.

Fabricators

Fabricators order intake continues to be significantly positive, showing a net improvement of 55 percentage points, the most significant increase the sector has seen since the third quarter of 2021.

Forecast

Looking at the next 3 months, forecasts remain broadly positive for most company sizes and sectors. Fabricators is the most positive overall except for export orders which is overall flat where they report significant increase in export prices ( net+50%). For the second quarter running, Precision Engineering shows the largest planned increase in employees (+70%) despite flat and decreasing UK and export orders, which may indicate a lack of skills limiting order fulfilment. Medium size companies are showing the highest forecast for output volume (+41%), whilst order intake remains a concern for Metal Products and Electrical & Electronics with a forecast decline of -50% and -33% respectively. Metal Products are also expecting a decline of -75% on order intake and staffing reflects that in a -40% outlook. Overall, the forecast remains positive but there are some indices here that deserve caution and close attention for the upcoming quarter. With Bank of England interest rates increasing for the fourth time in less than six months the impact on business positivity and may have been impacted for all sizes of businesses and sectors.

| Net | Up | Same | Down | |

Orders | 18% | 37% | 44% | 19% |

UK Orders | 14% | 32% | 50% | 18% |

Export Orders | -1% | 22% | 55% | 23% |

Output Volume | 30% | 44% | 42% | 14% |

Balance of change %

| Order Intake UK | Orders Export | Prices UK | Prices Export | Output Volume | Employees | |

|---|---|---|---|---|---|---|

| Small | 14 | -5 | 22 | 26 | 26 | 34 |

| Medium | 19 | 5 | 23 | 22 | 41 | 44 |

| Large | 0 | 0 | -20 | 0 | 20 | 40 |

| Metal Products | -50 | -75 | 0 | 0 | 0 | -25 |

| Precision Engineering | 0 | -20 | 43 | 50 | 29 | 71 |

| Electrical & Electronics | -33 | -33 | 17 | 17 | 0 | 33 |

| Fabricators | 30 | 0 | 36 | 50 | 27 | 18 |

| Manufacturing | 13 | 0 | 30 | 23 | 32 | 36 |

| Plant & Machinery | 11 | 17 | 0 | 33 | 33 | 33 |