A swing back to positive overall order intake leads that mood, and whilst it’s not experienced in all sectors, for UK orders all but one sector shows an improved position. The feedback we report on forecast-forward and optimism - both significantly positive compared to the previous quarter - are well aligned, suggesting that the predicted order book feels solid enough to bring that confidence. Whilst inflation is stabilising, its recent history leaves challenging wage inflation and energy costs, and that is reflected in forecasts for price increases. Businesses need margin to survive, but concern for our competitiveness outside the UK remains a concern from that impact.

Key attention points from this quarter:

- Order intake amongst members improved by twelve percentage points to a balance of positive 8% from negative 4% last quarter, with exports once again leading the way

- Output volume remained net positive at 4%, softened from a net balance of 9% last quarter

- For the coming three months, members forecast a net increase of 35% of businesses having increased orders, with output forecast for a net 32% increase in the same period

- Optimism steps more positive than last quarter – at a balance of 19% positive, with large companies and plant and machinery with the highest confidence of positive 50% and 42% respectively

The data in this Review were acquired by a survey of Scottish Engineering’s members and certain other manufacturing companies.

35% of members responded

Companies are described as:

Small (<100 employees), Medium (100–500) and Large (>500)

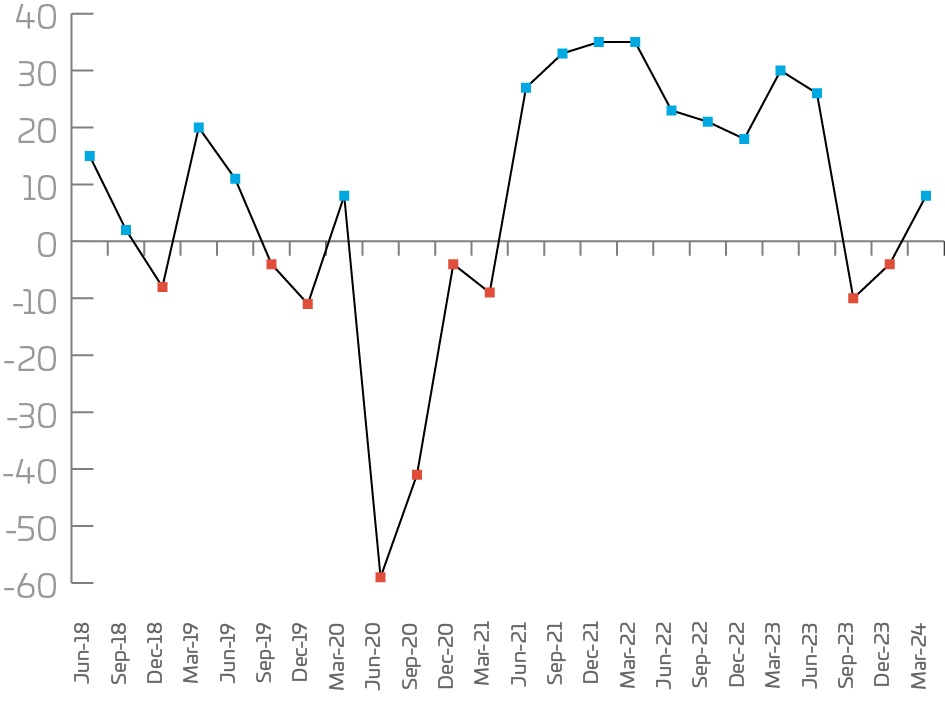

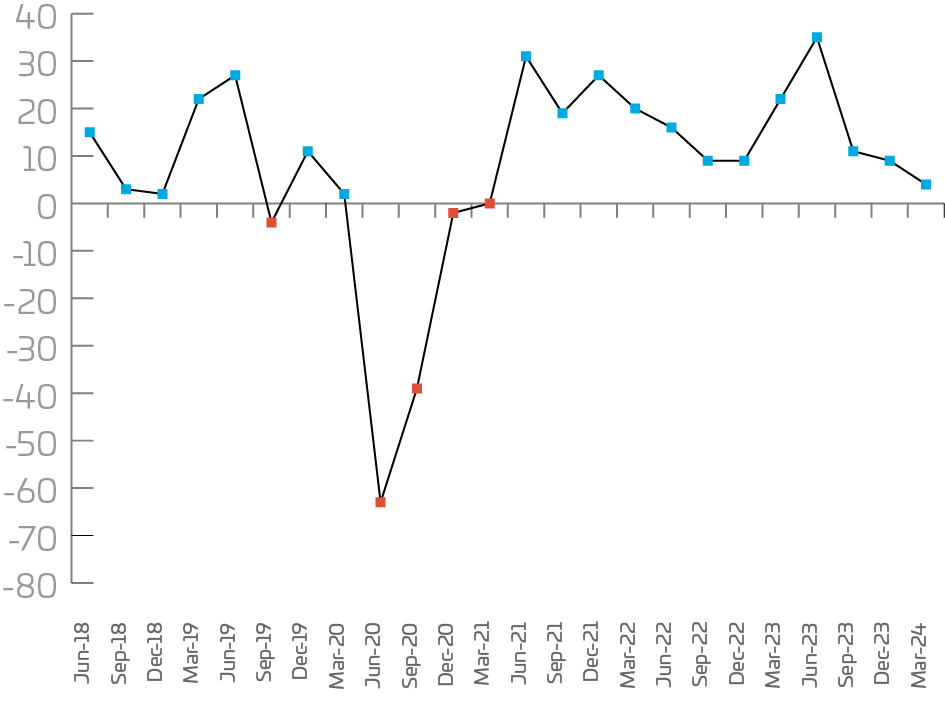

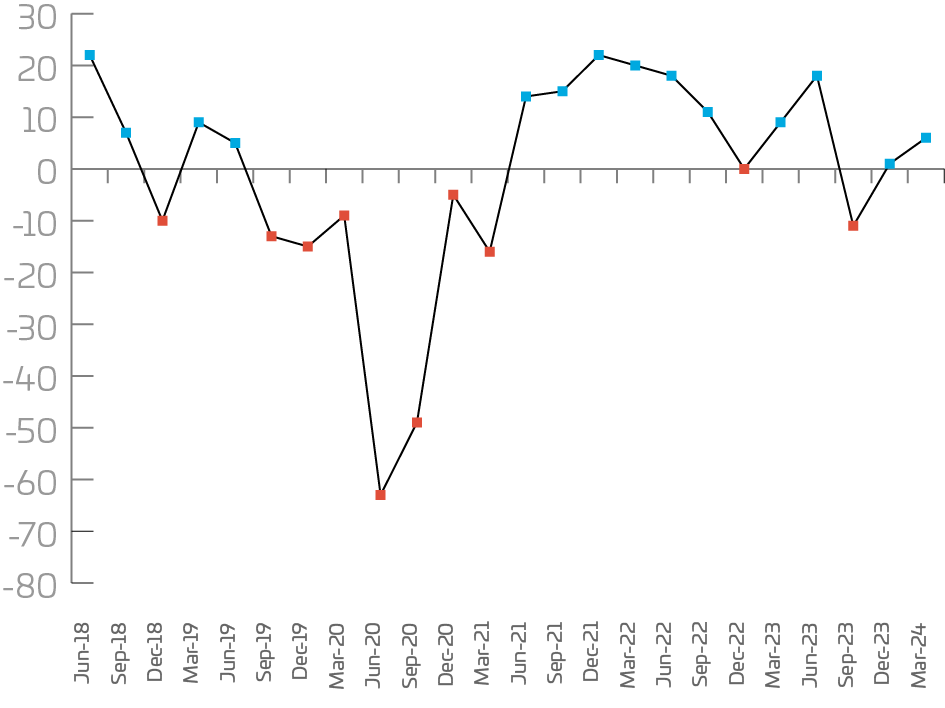

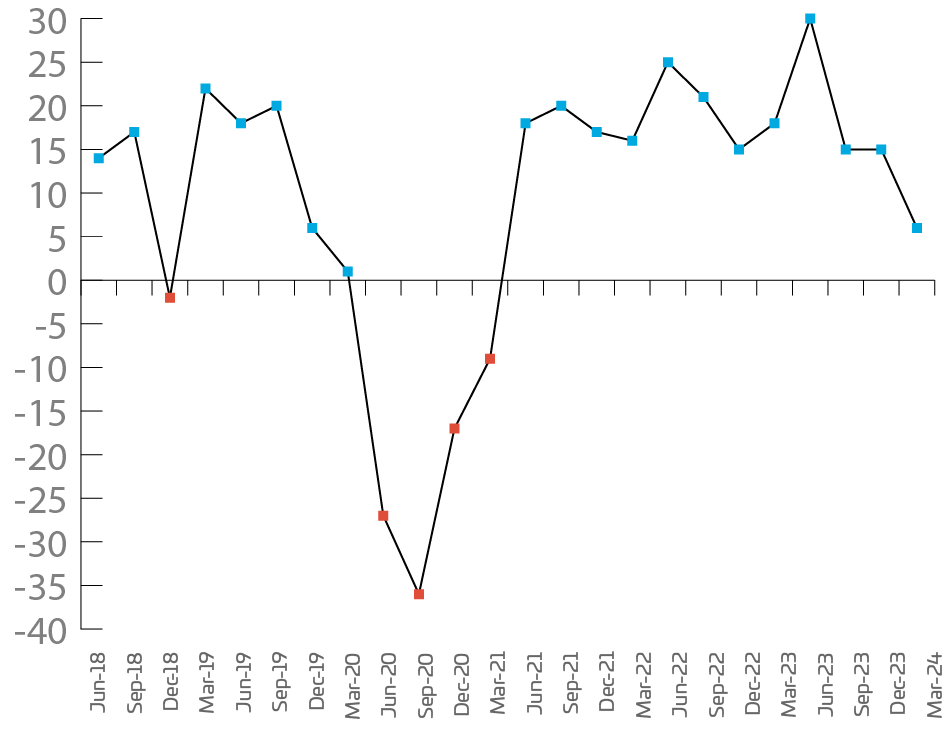

Annual trends

After two quarters negative, order intake recorded an increase of 12% to +8%, whilst output volume declined 5% on last quarter but remains positive overall at +4%. Exports have seen another positive quarter, a 5% change from +1% to +6%. Staffing has seen the largest decline this quarter falling 9 percentage points to +6%, and capacity utilisation records another positive quarter with a net of +8%, an increase of 6% on last quarter.

Order intake

Output volume

Exports

Staffing

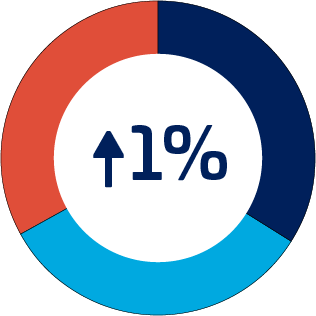

UK Orders

Net | Up | Same | Down |

1% | 34% | 33% | 33% |

UK orders have improved from last quarter with a shift from -10% to +1%. Small companies have been impacted for a consecutive third quarter with negative returns, albeit with a positive movement of 10 percentage points to -4% from last quarter. Medium companies are the most increased gaining 14% on last quarter from (-4% to +10%) but larger companies have declined 25% from last quarter (50% to 25%). Metal Products, Fabricators and Precision Engineering are, for the third quarter, reporting negative returns (-50%, -20% and -10% respectively), but have shown a positive trajectory in comparison to last quarter (-67%, -27% and -30%). Electrical & Electronics show a further decline from last quarter (-25% to -40%). Plant & Machinery indicate the largest decline this quarter with a decline of 37% (10% to -27%). Manufacturing shows equal positive and negative returns this quarter.

Companies | Net | Up | Same | Down |

| Small | -4% | 33% | 30% | 37% |

Medium | 9% | 35% | 39% | 26% |

Large | 25% | 50% | 25% | 25% |

Sectors |

|

|

|

|

Manufacturing | 0% | 40% | 20% | 40% |

Plant & Machinery | -27% | 18% | 37% | 45% |

Metal | -50% | 0% | 50% | 50% |

Precision | -10% | 30% | 30% | 40% |

Fabricators | -20% | 20% | 40% | 40% |

Electrical & Electronics | -40% | 20% | 20% | 60% |

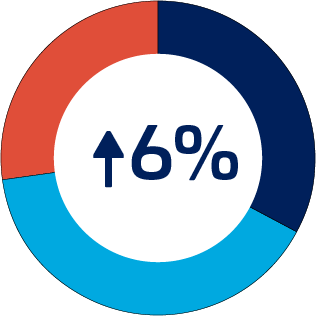

Export Orders

Net | Up | Same | Down |

6% | 33% | 40% | 27% |

Export orders have seen a positive movement for a consecutive second quarter with a movement from +1% to +6% as an sum of all sectors and sizes. Larger companies report a decline from +100% to -50%, and small companies remain static this quarter, showing equal positive and negative returns. Medium companies report an upward trajectory of +36% (-15% to +21%), and precision Engineering reporting a strong positive swing of 80% (-67% to +13%). Plant & Machinery also remain positive at +30% but with a slight decline on last quarter of -20%. Electrical & Electronics, Fabricators and Manufacturing show a decline this quarter of -25%, -20% and -9% respectively from last quarter, a fall of 50%, 20% and 13% respectively. Metal products, although showing a negative return of -25%, have improved on last quarter by 42%.

Companies | Net | Up | Same | Down |

Small | 0% | 27% | 46% | 27% |

Medium | 21% | 46% | 29% | 25% |

Large | -50% | 0% | 50% | 50% |

Sectors |

|

|

|

|

Manufacturing | -9% | 26% | 39% | 35% |

Plant & Machinery | 30% | 40% | 50% | 10% |

Metal | -25% | 25% | 25% | 50% |

Precision | 12% | 50% | 12% | 38% |

Fabricators | -20% | 0% | 80% | 20% |

Electrical & Electronics | -25% | 25% | 25% | 0% |

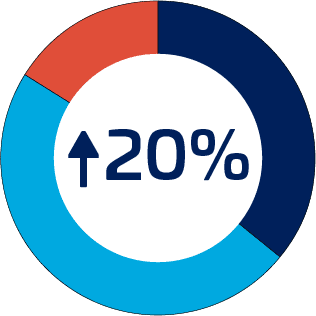

Optimism

Net | Up | Same | Down |

20% | 36% | 48% | 16% |

Optimism remains positive overall with a net 19% for all companies and sectors, improving by +15% on last quarter. All sizes of companies remain positive for a second consecutive quarter: small (14%), medium (30%), larger (50%). Sectors remain positive in their outlook, with Plant & Machinery, Electrical & Electronics and Precision Engineering being most optimistic (+42%, +33%, and +10% respectively). Manufacturing, Metal Products and Fabricators are flat this quarter showing equal positive and negative returns however Fabricators has improved from -42% last quarter to 0% this quarter, and metal products follows this direction moving from -50% to 0%.

Companies | Net | Up | Same | Down |

Small | 14% | 33% | 47% | 20% |

Medium | 30% | 39% | 52% | 9% |

Large | 50% | 50% | 50% | 0% |

Sectors |

|

|

|

|

Manufacturing | 0% | 23% | 54% | 23% |

Plant & Machinery | 42% | 50% | 42% | 8% |

Metal | 0% | 25% | 50% | 25% |

Precision Engineering | 10% | 40% | 30% | 30% |

Fabricators | 0% | 19% | 62% | 19% |

Electrical & Electronics | 33% | 50% | 33% | 17% |

Output Volume

Net | Up | Same | Down |

5% | 35% | 35% | 30% |

Output volume remains positive this quarter at 4%, slightly lower than last quarter (10%). All sizes of companies remain positive at +4%, +3% and +25% respectively. Electrical & Electronics and Plant & Machinery show positivity at +20% and +17%. Fabricators, Manufacturing and Precision Engineering show negative returns this quarter at -19%, -15% and -10% respectively and Metal Products have equal positive and negative returns this quarter.

Companies | Net | Up | Same | Down |

Small | 4% | 33% | 38% | 29% |

Medium | 3% | 36% | 31% | 33% |

Large | 25% | 50% | 25% | 25% |

Sectors |

|

|

|

|

Manufacturing | -15% | 31% | 23% | 46% |

Plant & Machinery | 17% | 25% | 67% | 8% |

Metal | 0% | 25% | 50% | 25% |

Precision | -10% | 40% | 10% | 50% |

Fabricators | -18% | 13% | 56% | 31% |

Electrical & Electronics | 20% | 60% | 0% | 40% |

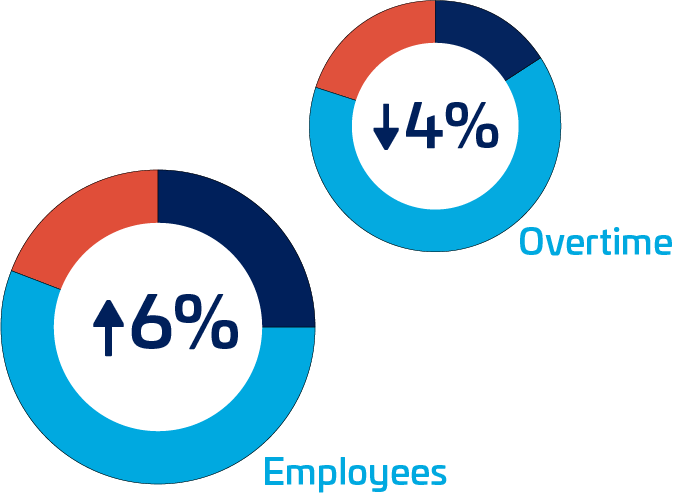

Staffing

Net | Up | Same | Down |

6% | 25% | 56% | 19% |

Employee number are positive for most sizes of companies, small (+10%) and large (+50%) however medium companies show a decline this quarter of -9% (+20% last quarter). Manufacturing shows negativity this quarter at -4%, a decline of 23% on last quarter. Electrical & Electronics show the most significant decline on last quarter of -47 percentage points.

Companies | Net | Up | Same | Down |

Small | 10% | 25% | 60% | 15% |

Medium | -9% | 21% | 49% | 30% |

Large | 50% | 50% | 50% | 0% |

Sectors |

|

|

|

|

Manufacturing | -4% | 19% | 58% | 23% |

Plant & Machinery | 8% | 33% | 42% | 25% |

Metal | 25% | 25% | 75% | 0% |

Precision | 10% | 30% | 50% | 20% |

Fabricators | 13% | 19% | 75% | 6% |

Electrical & Electronics | 33% | 33% | 67% | 0% |

Overtime

Overtime has seen a slight decline this quarter with larger companies reporting the largest decline of -50% (+50% last quarter) indicative mainly to the reduction in export orders.

Companies | Net | Up | Same | Down |

-4% | 16% | 64% | 20% | |

Small | -6% | 14% | 66% | 20% |

Medium | 6% | 22% | 62% | 16% |

Large | -50% | 0% | 50% | 50% |

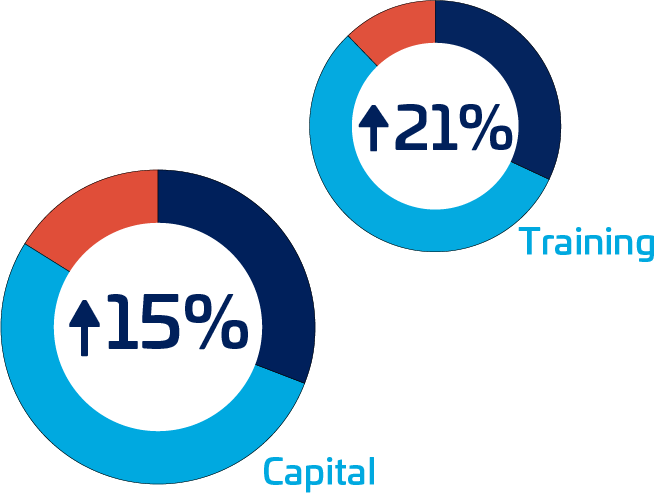

Investment

Net | Up | Same | Down |

15% | 31% | 53% | 16% |

Capital investment plans remain positive overall at +14%, equal to last quarter with smaller and medium companies reporting highest increases at 19% and 3% respectively and improving on last quarter. Larger companies also remain positive at 25% but a decline of -75% on last quarter. Manufacturing and Metal Products are reporting equal positive and negative returns on last quarter. Electrical & Electronics are, for the third consecutive quarter showing the highest levels of investment with plans at +80% (+60% last quarter) followed by Plant & Machinery (+25%) and Precision Engineering (+11%) however Fabrications show a decline of -6% this quarter.

Companies | Net | Up | Same | Down |

Small | 19% | 35% | 49% | 16% |

Medium | 3% | 18% | 67% | 15% |

Large | 25% | 50% | 25% | 25% |

Sectors |

|

|

|

|

Manufacturing | 0% | 12% | 76% | 12% |

Plant & Machinery | 25% | 42% | 41% | 17% |

Metal | 0% | 25% | 50% | 25% |

Precision | 11% | 33% | 45% | 22% |

Fabricators | -6% | 19% | 56% | 25% |

Electrical & Electronics | 80% | 80% | 20% | 0% |

Training Investment

Reflecting the skills challenges across industry, all sizes of companies are reporting increased plans for training investment, with larger companies strongest with a net 25% of these companies reporting increased training plans, albeit a decline of 100% last quarter. Small and medium sized companies also show positive net increases of +21% (30% last quarter) and +18% (12% last quarter) respectively.

Companies | Net | Up | Same | Down |

21% | 32% | 56% | 12% | |

Small | 22% | 33% | 56% | 11% |

Medium | 18% | 33% | 52% | 15% |

Large | 25% | 25% | 75% | 0% |

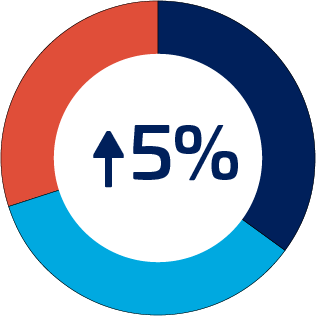

Capacity Utilisation

Capacity Utilisation remains positive with net +8% of companies reporting that they are at capacity, an increase of 6% compared to last quarter.

Plant & Machinery

Plant & Machinery order intake has been impacted this quarter with a significant decrease from 20% to -17%, a movement of 37% that has not been recorded since Q3 2020. This is reflective of their decreased UK orders (-27%), but export order have increased (+30%) as has staffing (+8%) and Investment plans (25%) with optimism most significant at +42%.

Forecast

Looking at the next 3 months, forecasts reflect a more positive outlook with all sizes of companies and sectors avoiding negative outlooks. All sizes of companies report positivity overall in all areas with larger companies reporting the most positivity in order intake, order exports and output volume, all at 100%. Precision Engineering, Manufacturing and Plant & Machinery forecast positivity in all areas (order intake, order exports, prices UK, prices export, output volume and employees). Fabricators are reporting a decline in orders export (-20%) and prices UK (-6%) but positive in all other areas. Metal Products forecasts have seen the most improvement on last quarter with prices UK at +50% (0%), prices exports at +50% (0%) and employees +25% (0%). Forecasts for orders records an improvement of +29% (6% to 35%), UK order +34% (-3% to 31%), export orders +24% (-3% to 21%) and output volume +26% (15% to 41%).

| Net | Up | Same | Down | |

Orders | 35% | 47% | 41% | 12% |

UK Orders | 31% | 42% | 47% | 11% |

Export Orders | 21% | 32% | 57% | 11% |

Output Volume | 41% | 50% | 42% | 9% |

Balance of change %

| Order Intake UK | Orders Export | Prices UK | Prices Export | Output Volume | Employees | |

|---|---|---|---|---|---|---|

| Small | 30 | 25 | 37 | 33 | 36 | 21 |

| Medium | 23 | 7 | 19 | 21 | 45 | 30 |

| Large | 100 | 100 | 25 | 50 | 100 | 75 |

| Metal Products | 0 | 0 | 50 | 50 | 0 | 25 |

| Precision Engineering | 40 | 25 | 30 | 50 | 60 | 40 |

| Electrical & Electronics | 25 | 0 | 0 | 0 | 33 | 67 |

| Fabricators | 13 | -20 | -6 | 0 | 25 | 19 |

| Manufacturing | 24 | 30 | 33 | 22 | 50 | 15 |

| Plant & Machinery | 9 | 30 | 55 | 50 | 25 | 17 |