Key highlights from this quarter:

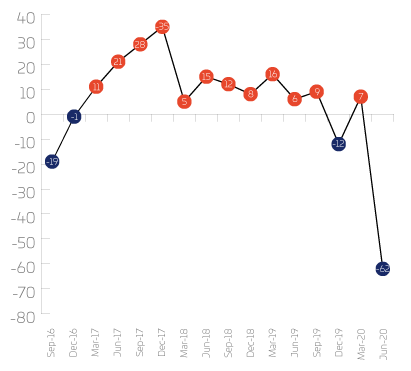

- Confidence falls from +17% to – 63% in three months

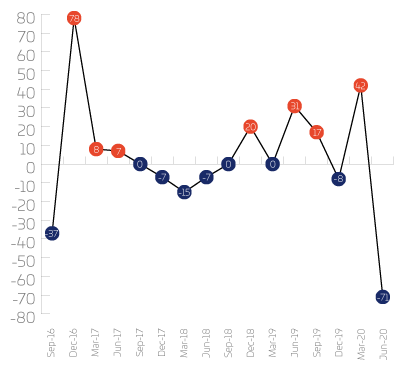

- Forecast orders for next three months show UK and Export falling over 50%

- 72% of companies plan to reduce training and apprenticeships

- Four out of five companies considering redundancies in the next six months

The data in this Review were acquired by a survey of Scottish Engineering’s members and certain other manufacturing companies.

45% of members responded

Companies are described as:

Small (<100 employees), Medium (100–500) and Large (>500)

Order intake, output volume, exports and staffing have all dipped considerably, to levels that have not been recorded before in a single quarter. Order intake has dipped by 67 percentage points, output volume by 65 percentage points, exports by 54 percentage points and staffing by 28 percentage points.

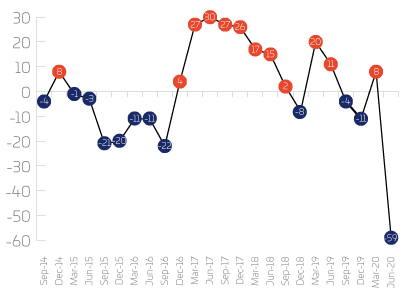

Order intake

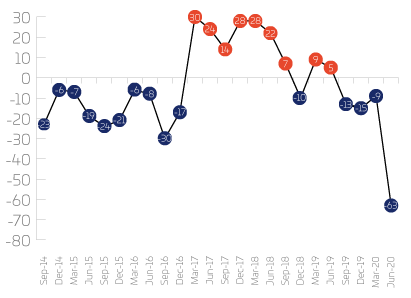

Output volume

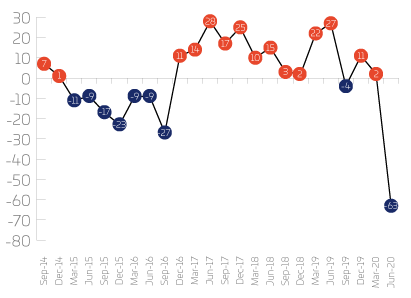

Exports

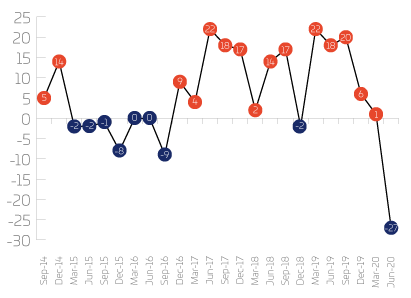

Staffing

Net | Up | Same | Down | |

UK Orders | -60% | 13% | 14% | 73% |

Small companies | -57% | 17% | 8% | 75% |

Medium companies | -62% | 6% | 26% | 68% |

Large companies | -80% | 0% | 20% | 80% |

Machine shops | -100% | 0% | 0% | 100% |

Mechanical | -72% | 9% | 10% | 81% |

Metal | -44% | 22% | 11% | 67% |

Non-metal | -50% | 17% | 16% | 67% |

Fabricators | -69% | 8% | 15% | 77% |

Electronics | -43% | 14% | 29% | 57% |

UK orders are negative, with the balance of change at -60%. All sizes of company are reporting decreases, and it is a similar picture within the sectors, particularly machine shops where 100% of companies are reporting a downturn.

Net | Up | Same | Down | |

Export Orders | -63% | 8% | 21% | 71% |

Small companies | -62% | 9% | 20% | 71% |

Medium companies | -64% | 6% | 24% | 70% |

Large companies | -60% | 20% | 0% | 80% |

Machine shops | -80% | 0% | 20% | 80% |

Mechanical | -75% | 6% | 13% | 81% |

Metal | -86% | 0% | 14% | 86% |

Non-metal | -60% | 20% | 0% | 80% |

Fabricators | -67% | 0% | 33% | 67% |

Electronics | -43% | 0% | 57% | 43% |

Export orders are negative for all sizes of company. The balance of change is -62% for small companies, -64% for medium companies, and -60% for large companies. In the sectors the balance of change is -80% for machine shops, -75% for mechanical equipment, -86% for metal manufacturing, -60% for non-metal products, -67% for fabricators and -43% for electronics.

Net | Up | Same | Down | |

Optimism | -63% | 4% | 30% | 66% |

Small companies | -61% | 4% | 30% | 66% |

Medium companies | -66% | 3% | 28% | 69% |

Large companies | -60% | 0% | 40% | 60% |

Machine shops | -71% | 0% | 29% | 71% |

Mechanical equipment | -83% | 0% | 17% | 83% |

Metal manufacturing | -33% | 0% | 67% | 33% |

Non-metal products | -83% | 0% | 17% | 83% |

Fabricators | -43% | 14% | 29% | 57% |

Electronics | -63% | 0% | 37% | 63% |

Optimism has dipped and is 80% points lower than last quarter. All sizes of company are reporting decreases. In the various sectors machine shops, mechanical equipment, non-metal products and electronics are reporting the greatest decreases.

Net | Up | Same | Down | |

Output volume | -63% | 11% | 15% | 74% |

Small companies | -66% | 12% | 10% | 78% |

Medium | -57% | 11% | 20% | 69% |

Large companies | -60% | 0% | 40% | 60% |

Machine shops | -100% | 0% | 0% | 100% |

Mechanical | -80% | 6% | 8% | 86% |

Metal | -44% | 22% | 11% | 67% |

Non-metal | -67% | 17% | 0% | 83% |

Fabricators | -79% | 0% | 21% | 79% |

Electronics | -38% | 13% | 37% | 50% |

Output volume has dipped 65% points since last quarter and all sizes of company are reporting decreases. All sectors are reporting decreases, with machine shops, mechanical equipment and fabricators reporting the greatest fall, at more than 75%.

Net | Up | Same | Down | |

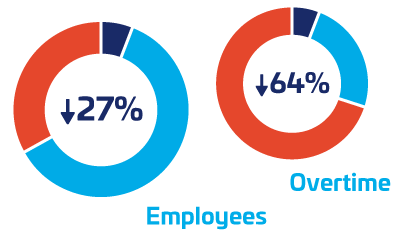

Staffing | -27% | 6% | 61% | 33% |

Small companies | -32% | 6% | 56% | 38% |

Medium | -17% | 9% | 65% | 26% |

Large companies | -20% | 0% | 80% | 26% |

Machine shops | -38% | 0% | 62% | 38% |

Mechanical | -29% | 6% | 60% | 34% |

Metal | -33% | 11% | 45% | 44% |

Non-metal | -17% | 0% | 83% | 17% |

Fabricators | -36% | 7% | 50% | 43% |

Electronics | -38% | 0% | 62% | 38% |

Employees

All sizes of company and all sectors have reported decreases in staffing numbers. Small companies reported the largest decrease at -32%, medium companies and large companies were slightly less, at -17% and -20% respectively. Significantly, 80% of respondents reported that they expect staffing to reduce in the next 6 months.

Net | Up | Same | Down | |

Overtime | -64% | 6% | 24% | 70% |

Overtime working has decreased significantly for all sizes of companies.

Net | Up | Same | Down | |

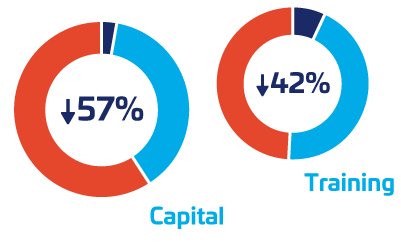

Investment | -56% | 3% | 38% | 59% |

Small companies | -53% | 3% | 41% | 56% |

Medium | -63% | 3% | 31% | 66% |

Large companies | -60% | 0% | 40% | 60% |

Machine shops | -71% | 0% | 29% | 71% |

Mechanical | -69% | 0% | 31% | 69% |

Metal | -44% | 0% | 56% | 44% |

Non-metal | -33% | 0% | 67% | 33% |

Fabricators | -50% | 14% | 22% | 64% |

Electronics | -50% | 0% | 50% | 50% |

Investment

Capital investment plans have fallen, with all sectors and sizes of company reporting negative returns.

Net | Up | Same | Down | |

Training investment | -42% | 7% | 44% | 49% |

Capital investment plans have fallen, with all sectors and sizes of company reporting negative returns.

Capacity Utilisation

Capacity utilisation has dipped 69 percentage points – the largest quarterly drop recorded.

Fabricators

Order intake total Fabricators order intake has dropped significantly in the last quarter.

Forecast

The last three months have been extremely difficult for our sector and forecasts for the next three months do not look to improve. In general, UK orders, export orders and output volume are all forecast to dip. Small and medium companies are forecasting negative figures for all measurements. Large companies are forecasting an increase in export prices.

Metal manufacturing and non-metal products are forecasting an increase in UK prices, but forecasting decreases in order intake, export orders, output volume and employee numbers. Electronics, fabricators, machine shops and mechanical equipment are forecasting decreases for all measurements.

| Net | Up | Same | Down | |

Orders | -56% | 17% | 10% | 73% |

UK Orders | -57% | 14% | 15% | 71% |

Export Orders | -53% | 15% | 17% | 68% |

Output Volume | -55% | 15% | 15% | 70% |

Balance of change %

| Order Intake UK | Orders Export | Prices UK | Prices Export | Output Volume | Employees | |

|---|---|---|---|---|---|---|

| Small | -65 | -58 | -17 | -25 | -63 | -53 |

| Medium | -44 | -45 | -12 | -13 | -43 | -34 |

| Large | -40 | -60 | 0 | 25 | -25 | -60 |

| Metal Manufacturing | -56 | -71 | 11 | 0 | -67 | -22 |

| Non-Metal Products | -67 | -60 | 17 | 0 | -67 | -33 |

| Electronics | -57 | -43 | -14 | -14 | 0 | 0 |

| Fabricators | -46 | -80 | -21 | -40 | -57 | -71 |

| Machine Shops | -71 | -40 | -50 | -50 | -71 | -63 |

| Mechanical Equipment | -56 | -48 | -9 | -13 | -54 | -54 |