Key attention points from this quarter:

- Order intake, Output Volume, Exports and Staffing remain strongly positive for the second consecutive quarter since the pandemic started

- Order intake for the last 3 months up 33%, forecast further positive 36% for next 3 months

- Optimism holds positive at net 21% positive

- UK and Export prices continue to reflect raw material price increases with net 47% and 46% increased respectively

The data in this Review were acquired by a survey of Scottish Engineering’s members and certain other manufacturing companies.

37% of members responded

Companies are described as:

Small (<100 employees), Medium (100–500) and Large (>500)

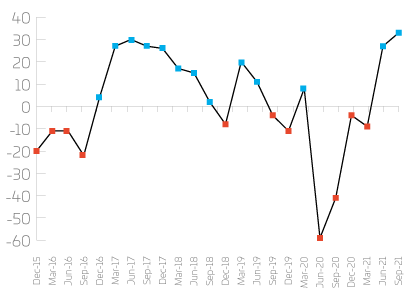

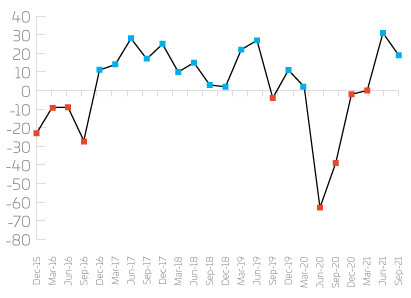

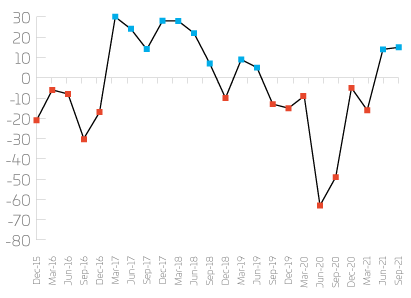

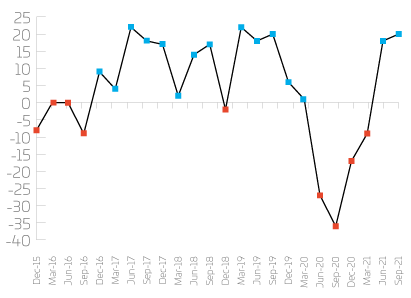

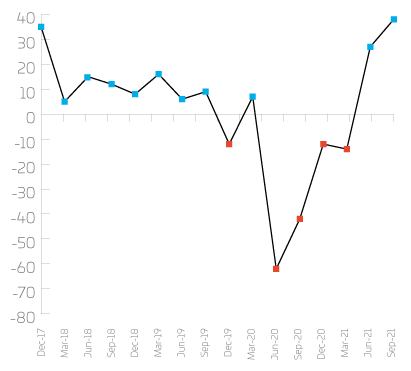

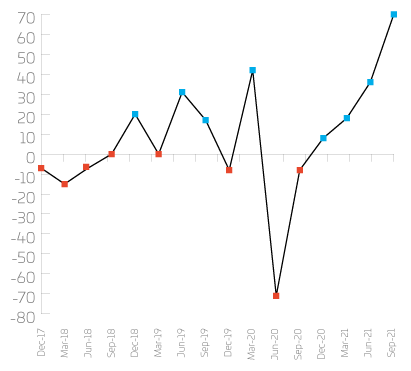

Annual trends

Order intake, exports and staffing have all further improved since last quarter, whilst output volume remains positive albeit at a slightly reduced rate. Order intake increases its positive path quarter on quarter by a further 6 percentage points, and an overall 33 percent positive position

Order intake

Output volume

Exports

Staffing

UK Orders

Net | Up | Same | Down |

27% | 46% | 35% | 19% |

UK orders have remained positive, with the balance of change at 27% (9% more than last quarter). All sizes of company are reporting increases, with all sectors positive or reporting equal numbers of increases and decreases. Fabricators record a balance of 73% positive with 82% reporting increases.

Companies | Net | Up | Same | Down |

Small | 17% | 41% | 35% | 24% |

Medium | 48% | 56% | 37% | 7% |

Large | 25% | 50% | 25% | 25% |

Sectors |

|

|

|

|

Machine | 0% | 33% | 34% | 33% |

Mechanical | 35% | 57% | 21% | 22% |

Metal | 38% | 50% | 37% | 13% |

Non-metal | 0% | 20% | 60% | 20% |

Fabricators | 73% | 82% | 9% | 9% |

Electronics | 25% | 50% | 25% | 25% |

Export Orders

Net | Up | Same | Down |

15% | 38% | 38% | 24% |

Export orders have also remained positive this quarter, with the balance of change at 15%. All sizes of company are reporting increases, the balance of change is 8% for small companies, 25% for medium companies, and 25% for large companies. All sectors are positive; the balance of change is 57% for electronics, 25% for mechanical equipment, 29% for non-metal products, 17% for fabricators, and 29% for metal manufacturing; machine shops and non-metal products are reporting equal numbers of increases and decreases.

Companies | Net | Up | Same | Down |

Small | 8% | 43% | 22% | 35% |

Medium | 25% | 33% | 59% | 8% |

Large | 25% | 25% | 75% | 0% |

Sectors |

|

|

|

|

Machine | 0% | 40% | 20% | 40% |

Mechanical | 25% | 45% | 35% | 20% |

Metal | 29% | 43% | 43% | 14% |

Non-metal | 0% | 25% | 50% | 25% |

Fabricators | 17% | 33% | 50% | 17% |

Electronics | 57% | 71% | 15% | 14% |

Optimism

Net | Up | Same | Down |

21% | 38% | 45% | 17% |

Optimism has remained positive, with the balance of change at 21%. All sizes of company are reporting positive returns: small companies 22%, medium companies 31% and large companies 50%. Across the sectors it’s a similar scene, with only machine shops and non-metal products reporting negative returns.

Companies | Net | Up | Same | Down |

Small | 10% | 32% | 46% | 22% |

Medium | 43% | 50% | 43% | 7% |

Large | 25% | 50% | 25% | 25% |

Sectors |

|

|

|

|

Machine | -11% | 22% | 45% | 33% |

Mechanical | 32% | 48% | 36% | 16% |

Metal | 13% | 38% | 37% | 25% |

Non-metal | -20% | 20% | 40% | 40% |

Fabricators | 27% | 45% | 36% | 18% |

Electronics | 50% | 50% | 50% | 0% |

Output Volume

Net | Up | Same | Down |

19% | 40% | 39% | 21% |

Output volume remains positive with a lower rate of increase compared to last quarter, with the balance of change at 19%. All sizes of company are positive. Across the sectors, mechanical equipment, fabricators and electronics are reporting increases; and machine shops, metal manufacturing and non-metal products are reporting decreases.

Companies | Net | Up | Same | Down |

Small | 8% | 33% | 42% | 25% |

Medium | 37% | 48% | 41% | 11% |

Large | 50% | 75% | 0% | 25% |

Sectors |

|

|

|

|

Machine | -22% | 11% | 56% | 33% |

Mechanical | 36% | 48% | 40% | 12% |

Metal | -38% | 13% | 37% | 50% |

Non-metal | -40% | 20% | 20% | 60% |

Fabricators | 64% | 73% | 18% | 9% |

Electronics | 38% | 50% | 37% | 13% |

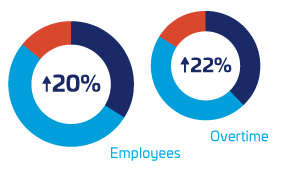

Staffing

Net | Up | Same | Down |

20% | 34% | 52% | 14% |

Employee numbers are positive for all sizes of company, with all large companies reporting increases. Mechanical equipment, non-metal products, fabricators and electronics are reporting increases; and machine shops and metal manufacturing are reporting decreases.

Companies | Net | Up | Same | Down |

Small | 3% | 20% | 63% | 17% |

Medium | 43% | 54% | 35% | 11% |

Large | 100% | 100% | 0% | 0% |

Sectors |

|

|

|

|

Machine | -22% | 11% | 56% | 33% |

Mechanical | 12% | 16% | 80% | 4% |

Metal | -25% | 13% | 49% | 38% |

Non-metal | 20% | 40% | 40% | 20% |

Fabricators | 64% | 73% | 18% | 9% |

Electronics | 38% | 38% | 62% | 0% |

Overtime

Overtime working has picked up, with all sizes of company reporting increases.

Companies | Net | Up | Same | Down |

22% | 38% | 46% | 16% | |

Small | 11% | 33% | 45% | 22% |

Medium | 41% | 48% | 45% | 7% |

Large | 50% | 50% | 50% | 0% |

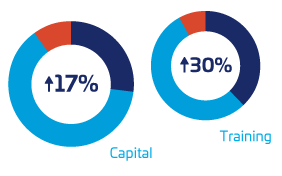

Investment

Net | Up | Same | Down |

17% | 27% | 63% | 10% |

Capital investment plans have improved since last quarter: small and medium sized companies are reporting positive returns and large companies reported equal numbers of increases and decreases. All sectors are reporting increases or equal numbers of increases and decreases.

Companies | Net | Up | Same | Down |

Small | 14% | 27% | 60% | 13% |

Medium | 25% | 32% | 61% | 7% |

Large | 0% | 0% | 100% | 0% |

Sectors |

|

|

|

|

Machine | 11% | 22% | 67% | 11% |

Mechanical | 13% | 21% | 71% | 8% |

Metal | 14% | 29% | 57% | 14% |

Non-metal | 40% | 40% | 60% | 0% |

Fabricators | 45% | 55% | 36% | 9% |

Electronics | 0% | 0% | 100% | 0% |

Training Investment

All sizes of company are reporting increases in training investment.

Companies | Net | Up | Same | Down |

30% | 38% | 54% | 8% | |

Small | 26% | 34% | 57% | 9% |

Medium | 36% | 43% | 50% | 7% |

Large | 50% | 50% | 50% | 0% |

Capacity Utilisation

Capacity utilisation has risen 11 percentage points since last quarter, the increase reflects the movement in order intake.

Order Intake Total: Fabricators

Fabricators order intake is positive for the fourth consecutive quarter, with an increase of 34% this quarter.

Forecast

Looking to the next 3 months, forecasts are good, with all measures positive. The net balance of change for overall orders is 36%, UK orders 34%, export orders 34% and output volume 37%. All sizes of company are forecasting positive figures for UK order intake, orders export, UK prices, export prices, output volume and employee numbers; and across the sectors all measurements are positive.

| Net | Up | Same | Down | |

Orders | 36% | 44% | 47% | 9% |

UK Orders | 34% | 46% | 42% | 12% |

Export Orders | 34% | 42% | 49% | 8% |

Output Volume | 37% | 50% | 37% | 13% |

Balance of change %

| Order Intake UK | Orders Export | Prices UK | Prices Export | Output Volume | Employees | |

|---|---|---|---|---|---|---|

| Small | 26 | 28 | 47 | 44 | 28 | 20 |

| Medium | 48 | 38 | 46 | 46 | 46 | 50 |

| Large | 50 | 75 | 50 | 67 | 100 | 100 |

| Metal Manufacturing | 13 | 14 | 50 | 43 | 25 | 25 |

| Non-Metal Products | 20 | 25 | 40 | 50 | 60 | 20 |

| Electronics | 25 | 29 | 25 | 14 | 50 | 63 |

| Fabricators | 45 | 17 | 64 | 67 | 45 | 55 |

| Machine Shops | 33 | 40 | 56 | 40 | 33 | 22 |

| Mechanical Equipment | 26 | 45 | 50 | 59 | 32 | 24 |