- 48% of Companies plan for increased apprentices in the next three to five years

- Order intake overall positive for last three and next three months

- A tough quarter for metal manufacturing showing falling order rate and the lowest optimism of all sectors

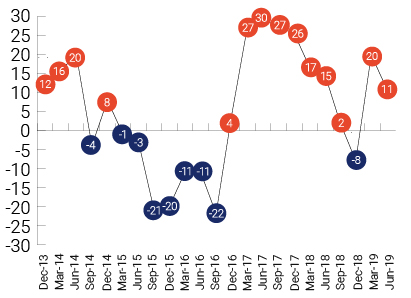

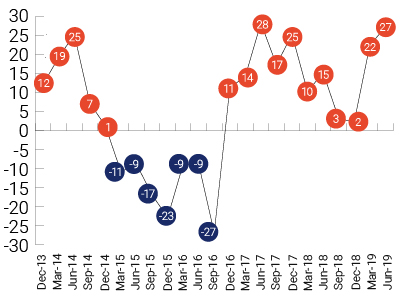

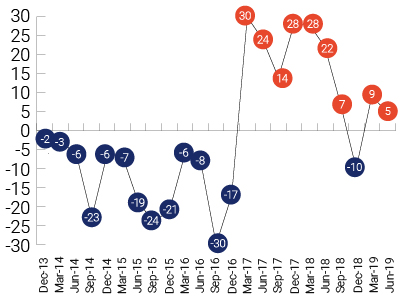

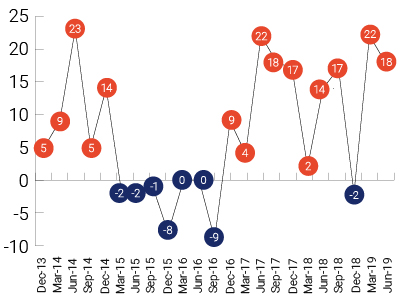

Annual Trends

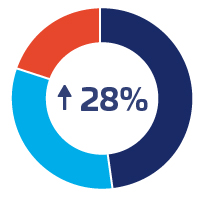

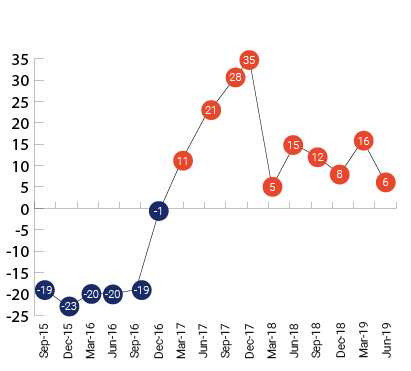

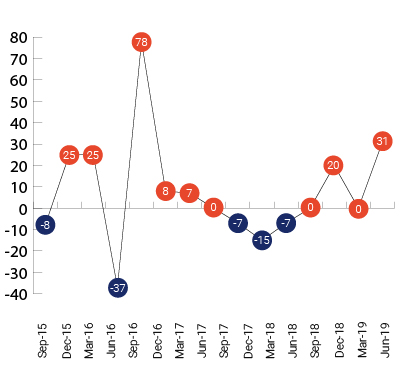

Order intake has dipped after a more positive increase last quarter; however, output volume has continued to increase and to rates not seen since June 2017.

Export levels remain positive but have slowed since last quarter. Staffing levels still show a positive intention, albeit at a lower level than prior quarter.

Order Intake

Output Volume

Exports

Staffing

Net | Up | Same | Down | |

UK Orders | 10% | 33% | 44% | 23% |

Small companies | 4% | 32% | 34% | 31% |

Medium companies | 22% | 32% | 58% | 10% |

Large companies | 20% | 20% | 80% | 0% |

Machine shops | 13% | 50% | 13% | 37% |

Mechanical equipment | 16% | 32% | 52% | 16% |

Metal manufacturing | -37% | 13% | 37% | 50% |

Non-metal products | 25% | 50% | 25% | 25% |

Fabricators | 32% | 46% | 38% | 14% |

Electronics | -17% | 0% | 83% | 17% |

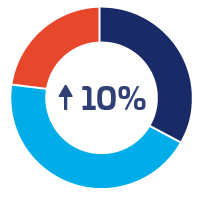

UK orders remain positive, with the balance of change at 10% (1% higher than last quarter). All sizes of company are positive. Within the sectors machine shops, mechanical equipment, non-metal products and fabricators are all reporting positive returns. Metal manufacturing and electronics have equal numbers of companies reporting increases and decreases; and fabricators are reporting negative figures.

Net | Up | Same | Down | |

Export Orders | 5% | 31% | 43% | 26% |

Small companies | 3% | 32% | 39% | 29% |

Medium companies | 7% | 31% | 45% | 24% |

Large companies | 25% | 25% | 75% | 0% |

Machine shops | 0% | 25% | 50% | 25% |

Mechanical equipment | 1% | 28% | 45% | 27% |

Metal manufacturing | 0% | 43% | 14% | 43% |

Non-metal products | 17% | 50% | 17% | 33% |

Fabricators | 15% | 29% | 57% | 14% |

Electronics | 20% | 40% | 40% | 20% |

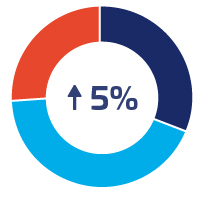

Export orders are positive within all sizes of company – 25% of large companies, 31% of medium companies and 32% of small companies are reporting an increase. In the sectors, mechanical equipment, non-metal products, fabricators and electronics are positive; and machine shops and metal manufacturing have a similar number of companies reporting increases and decreases.

Net | Up | Same | Down | |

Optimism | 5% | 25% | 55% | 20% |

Small companies | 0% | 26% | 48% | 26% |

Medium companies | 10% | 23% | 64% | 13% |

Large companies | 20% | 20% | 80% | 0% |

Machine shops | 37% | 50% | 37% | 13% |

Mechanical equipment | 15% | 31% | 53% | 16% |

Metal manufacturing | -50% | 0% | 50% | 50% |

Non-metal products | 0% | 25% | 50% | 25% |

Fabricators | -23% | 0% | 77% | 23% |

Electronics | -16% | 17% | 50% | 33% |

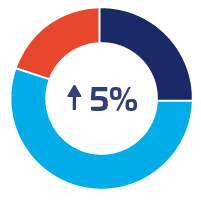

In general optimism has improved slightly. 23% of medium companies are reporting an increase and 20% of large companies are reporting an increase; 26% of small companies are reporting an increase, but the same percentage are also reporting a decrease. In the various sectors machine shops and mechanical equipment are positive; non-metal products are reporting equal numbers of increases and decreases; and machines shops, metal manufacturing, fabricators and electronics are reporting decreases in optimism.

Net | Up | Same | Down | |

Output Volume | 28% | 48% | 32% | 20% |

Small companies | 27% | 48% | 31% | 21% |

Medium companies | 31% | 50% | 31% | 21% |

Large companies | 0% | 20% | 60% | 20% |

Machine shops | 37% | 50% | 37% | 13% |

Mechanical equipment | 15% | 39% | 37% | 24% |

Metal manufacturing | 25% | 50% | 25% | 25% |

Non-metal products | 39% | 63% | 13% | 24% |

Fabricators | 39% | 54% | 31% | 15% |

Electronics | 16% | 33% | 50% | 17% |

Throughout the survey, output volume remains mainly positive, with small and medium companies reporting increases, and large companies reporting equal numbers of increases and decreases. All sectors are positive, with the largest balance of change seen in machine shops, non-metal products and fabricators.

Net | Up | Same | Down | |

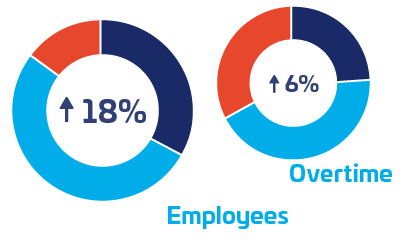

Staffing | 18% | 33% | 52% | 15% |

Small companies | 19% | 33% | 53% | 14% |

Medium companies | 21% | 34% | 53% | 13% |

Large companies | -20% | 20% | 40% | 40% |

Machine shops | 50% | 63% | 24% | 13% |

Mechanical equipment | 15% | 27% | 61% | 12% |

Metal manufacturing | -12% | 13% | 62% | 25% |

Non-metal products | 38% | 50% | 38% | 12% |

Fabricators | 31% | 31% | 66% | 0% |

Electronics | 0% | 17% | 66% | 17% |

Employees

Employee numbers have become more positive for small and medium companies, but they are down for large companies. Machine shops, mechanical equipment, non-metal products and fabricators have increased; metal manufacturing companies have reported a decrease, and electronics have reported equal numbers of increases and decreases.

Net | Up | Same | Down | |

Overtime | 6% | 30% | 46% | 24% |

Small companies | -9% | 24% | 43% | 33% |

Medium companies | 22% | 35% | 52% | 13% |

Large companies | 60% | 60% | 40% | 0% |

Overtime working continues in an increasing direction for medium and large companies, whilst small companies have fallen to a negative position.

Net | Up | Same | Down | |

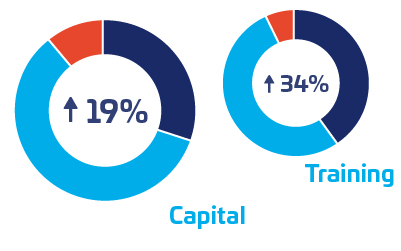

Investment | 19% | 30% | 59% | 11% |

Small companies | 16% | 31% | 54% | 15% |

Medium companies | 20% | 26% | 68% | 6% |

Large companies | 50% | 50% | 50% | 0% |

Machine shops | 13% | 50% | 37% | 25% |

Mechanical equipment | 22% | 32% | 58% | 10% |

Metal manufacturing | -24% | 13% | 50% | 37% |

Non-metal products | 38% | 50% | 38% | 12% |

Fabricators | -8% | 25% | 58% | 17% |

Electronics | 20% | 20% | 80% | 0% |

Investment

Capital investment plans have maintained similar positive levels to last quarter – all sizes of companies are positive. Within the sectors machine shops, mechanical equipment, non-metal products and electronics are positive; and metal manufacturing and fabricators are negative.

Net | Up | Same | Down | |

Training Investment | 34% | 39% | 56% | 5% |

Small companies | 33% | 40% | 53% | 7% |

Medium companies | 35% | 38% | 59% | 3% |

Large companies | 40% | 40% | 60% | 0% |

Training investment plans are at a similar level to last quarter. All sizes of company are reporting positive figures.

Capacity Utilisation

Remains positive, albeit at a lower level, for the tenth consecutive quarter.

Fabricators

Order intake total Fabricators order intake has returned to positive levels after an even balance last quarter. This trend also matches the significantly positive staffing rate (+31%) shown by fabricators.

Forecast

Forecasts for the next three months are less positive than last quarter. In general, export orders and output volume are forecast to pick up slightly, but UK orders are forecast to dip. Small companies are forecasting a dip in both UK and export orders, whilst medium companies are expecting a decrease in output volume, and large companies are forecasting a dip in prices and staffing.

Mechanical equipment is the only sector forecasting that the next quarter will be better than the previous. Metal manufacturing is expecting a decrease in exports; non-metal products are expecting a decrease in orders and output; electronics are expecting a decrease in orders and employees; fabricators are forecasting decreases in orders, export prices and output, but they expect UK prices to remain the same and employees to increase; and machine shops are expecting to be squeezed in the export market, but anticipate an increase in UK orders and prices, output volume and employee numbers.

| Net | Up | Same | Down | |

Orders | 4% | 31% | 42% | 27% |

UK Orders | -4% | 25% | 46% | 29% |

Export Orders | 2% | 26% | 50% | 24% |

Output Volume | 1% | 27% | 47% | 26% |

Balance of change %

| Order Intake UK | Orders Export | Prices UK | Prices Export | Output Volume | Employees | |

|---|---|---|---|---|---|---|

| Small | -11 | -7 | 15 | 0 | 3 | 19 |

| Medium | 6 | 7 | 6 | 10 | -6 | 22 |

| Large | 20 | 50 | -20 | -25 | 20 | -20 |

| Metal Manufacturing | 13 | -57 | 25 | 0 | 13 | 0 |

| Transport | -50 | -17 | 13 | 0 | -25 | 0 |

| Electronics | -17 | -20 | 0 | 0 | 0 | -17 |

| Fabricators | -31 | -43 | 0 | -14 | -31 | 15 |

| Machine Shops | 13 | -25 | 38 | -25 | 25 | 50 |

| Mechanical Equipment | 19 | 31 | 13 | 17 | 18 | 21 |